Wells Fargo Online Application Status: Your Guide to a Smooth Financial Journey

In today's fast-paced digital world, convenience is key, and our financial lives are no exception. From online banking to mobile payments, we're constantly seeking efficient ways to manage our money. When it comes to applying for financial products, the process should be just as seamless. That's where the ability to track your Wells Fargo online application status comes in, offering peace of mind and control every step of the way.

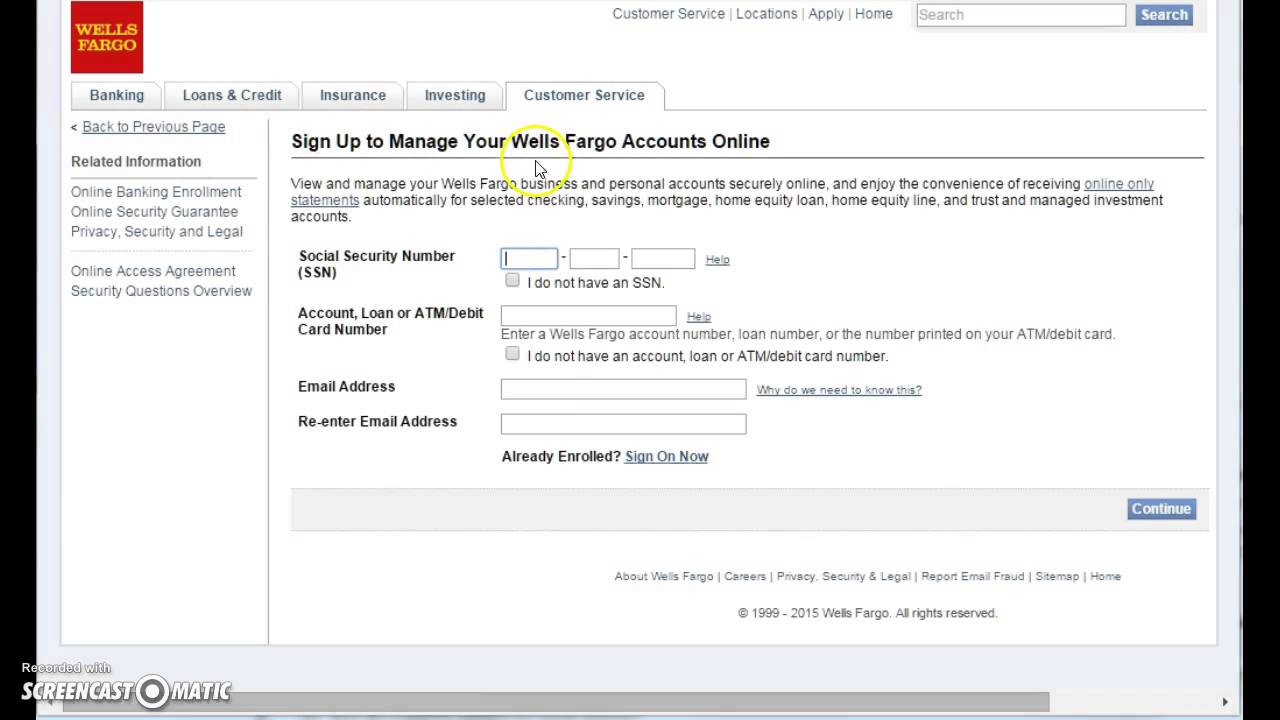

Imagine the scenario: you've meticulously filled out your application for a new credit card, mortgage, or personal loan. You've dotted your I's, crossed your T's, and eagerly hit the submit button. Now, the anticipation sets in. What happens next? With Wells Fargo's online application status feature, you're not left in the dark. It's like having a window into the progress of your application, giving you real-time updates and insights.

But it's not just about convenience. Knowing where you stand in the application process empowers you to be proactive. You can anticipate potential roadblocks, gather any necessary documents, and even reach out to a Wells Fargo representative if needed. This transparency fosters a sense of trust and confidence in your financial journey.

Navigating the world of financial applications can feel overwhelming, but it doesn't have to be. By embracing the digital tools at your fingertips, like Wells Fargo's online application status tracker, you can simplify the process and make informed decisions about your financial future. Let's delve deeper into the world of online application tracking and explore how it can empower you as a consumer.

Whether you're a seasoned applicant or venturing into the world of financial products for the first time, understanding the ins and outs of online application tracking is essential. It's about more than just checking a status; it's about taking control of your financial well-being and making informed choices that align with your goals.

Advantages and Disadvantages of Tracking Your Wells Fargo Online Application Status

| Advantages | Disadvantages |

|---|---|

| Convenience and Accessibility | Potential for Delays in Updates |

| Real-Time Updates | Limited Information in Some Cases |

| Proactive Management | Technical Issues |

Tips and Tricks for Navigating the Wells Fargo Online Application Process

Here are some helpful tips to ensure a smooth and efficient experience when tracking your Wells Fargo online application status:

- Bookmark the application status page: Keep it easily accessible for quick checks.

- Set up account notifications: Receive email or text alerts for any updates.

- Have your application reference number handy: This will help you retrieve your information faster.

- Be patient: Application processing times can vary. Allow sufficient time for each stage.

- Don't hesitate to reach out: If you encounter any issues or have questions, Wells Fargo's customer support is available to assist you.

In the realm of financial management, knowledge is power. By embracing digital tools like Wells Fargo's online application status feature, you equip yourself with the insights and control to navigate your financial journey with confidence. Remember, it's more than just checking a status; it's about taking charge of your financial well-being and making informed decisions that pave the way for a brighter financial future.

Seeking an oral surgeon in lexington ky consider dr peterson

Unlocking your dream car navigating the carmax used car market in warner robins ga

Albany pizza cravings your pizza hut lunch buffet guide