Unlocking USAA Credit Cards: Your Credit Score Guide

Navigating the world of credit cards can feel like stepping into a meticulously curated wardrobe – each card a unique garment with its own specific fit and purpose. When it comes to USAA credit cards, known for their tailored benefits for military members and their families, understanding the credit score landscape is essential. So, what credit score do you need for a USAA credit card? Let's explore this crucial element, unraveling the details like the fine stitching on a bespoke suit.

USAA doesn't publicly disclose specific credit score cutoffs for each of their cards. Think of it as a carefully guarded secret recipe. However, like a discerning eye for quality tailoring, you can infer the necessary creditworthiness based on the type of card and its features. Generally, premium cards with generous rewards programs and low interest rates require a higher credit score, similar to how a handcrafted Italian leather jacket commands a higher price tag than a mass-produced alternative. Securing a USAA credit card often hinges on having a good to excellent credit score, generally considered to be above 700. This isn't a hard and fast rule, but it provides a useful benchmark as you embark on your credit card journey.

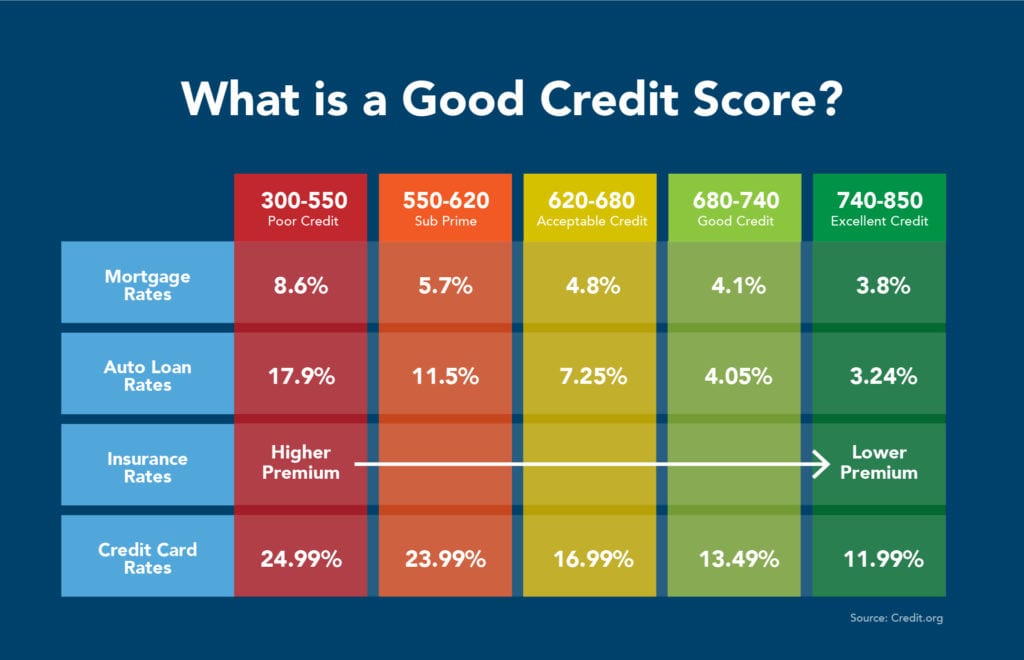

The importance of understanding the credit score requirement for a USAA credit card is paramount. Your credit score acts as a financial passport, a testament to your creditworthiness. Just as a well-maintained wardrobe speaks volumes about your personal style, a healthy credit score reflects your financial responsibility. It influences not only your approval odds but also the interest rates and credit limits you'll be offered. A higher credit score often unlocks more favorable terms, akin to gaining access to an exclusive collection of designer pieces.

Credit scores have a rich history, evolving from rudimentary assessments to the complex algorithms used today. Understanding this history helps to appreciate the power this three-digit number holds. The FICO score, the most commonly used credit scoring model, takes into account various factors, including payment history, amounts owed, length of credit history, new credit, and credit mix. Each factor contributes to the overall score, much like individual elements of an outfit contribute to a cohesive look.

One of the main issues related to understanding credit score requirements is the lack of transparency. While USAA doesn't publish specific cutoffs, they do emphasize the importance of a good credit standing. This can be frustrating for applicants, similar to trying to decipher a cryptic dress code. However, by focusing on improving your credit health overall, you can increase your chances of approval for the desired USAA credit card, much like refining your personal style to gain access to exclusive fashion circles.

Several benefits are associated with having a good credit score when applying for a USAA credit card. Lower interest rates mean less money spent on financing, allowing you to allocate those funds to other financial goals. Higher credit limits provide greater purchasing power and can positively impact your credit utilization ratio. Finally, a good credit score opens doors to premium rewards programs, offering valuable perks and cashback opportunities.

Advantages and Disadvantages of Focusing on Credit Score

| Advantages | Disadvantages |

|---|---|

| Higher approval chances | Can be time-consuming to improve score |

| Better interest rates | Doesn't guarantee approval |

| Higher credit limits | Other factors like income are also considered |

FAQ:

Q: Does checking my credit score hurt it? A: No, checking your own credit score is a soft inquiry and doesn't impact your score.

Q: How can I improve my credit score? A: Pay your bills on time, keep credit utilization low, and avoid opening too many new accounts.

In conclusion, understanding the role of your credit score in securing a USAA credit card is crucial. While specific score requirements remain undisclosed, focusing on maintaining a healthy credit profile is your best strategy. By following best practices, you can increase your chances of approval and unlock the benefits these cards offer, adding a valuable accessory to your financial wardrobe. Take the time to evaluate your credit standing, develop a plan for improvement, and explore the range of USAA credit cards to find the perfect fit for your financial needs.

The sweet celebration of pastel del cruz azul

Amy winehouses musical legacy a timeless soundtrack of heartbreak and soul

The great bolt debate unraveling the sae equivalent to an m10 bolt

:max_bytes(150000):strip_icc()/usaa-cashback-rewards-plus-american-express-card-c32f2cbc0ec744f396ae8a4391b13b89.jpg)