Unlocking the Seas: Your Guide to Boat Loan Credit Scores

Ever dreamed of captaining your own vessel, feeling the wind in your hair and the spray of the sea on your face? Owning a boat can be an incredible experience, but securing financing often hinges on one crucial factor: your credit score. So, what credit score do you need for a boat loan? Let's dive into the depths of this question and navigate the waters of boat loan financing.

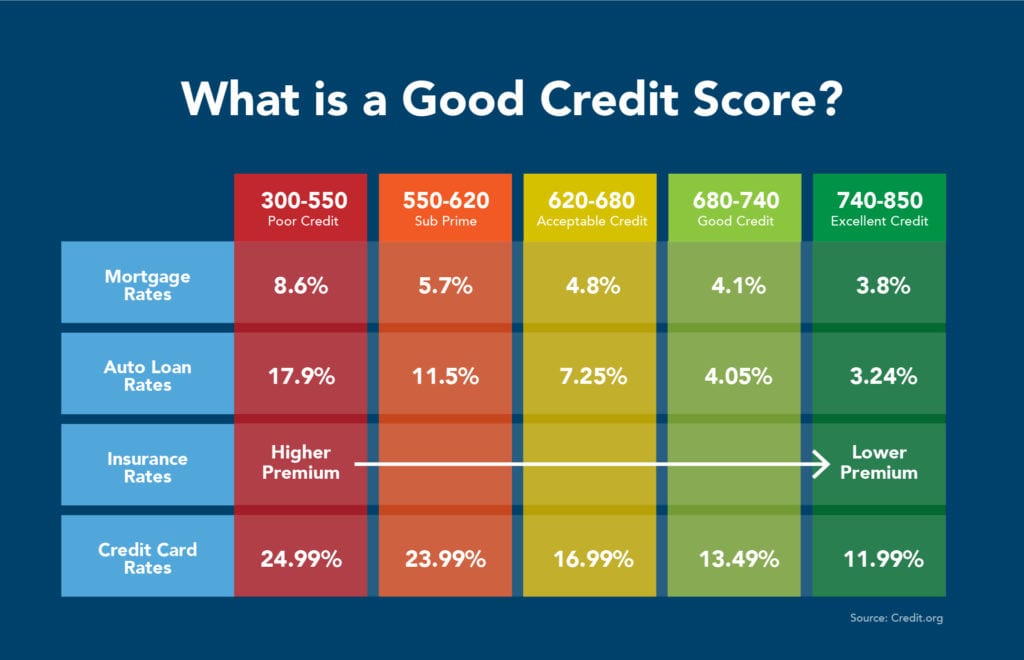

The world of boat loans can feel as vast and mysterious as the ocean itself. Understanding the role of your credit score is key to charting a successful course toward boat ownership. Essentially, lenders use your credit score as a barometer of your financial responsibility. It helps them assess the likelihood of you repaying the loan. The higher your score, the more likely you are to secure favorable loan terms, including lower interest rates and better repayment options.

While there's no magic number universally guaranteeing approval, a higher credit score undoubtedly improves your chances. Generally, a credit score above 700 is considered good for a boat loan, often unlocking the best interest rates and terms. However, some lenders might consider applicants with scores in the mid-600s, especially for smaller loan amounts or with a larger down payment. Scores below 600 may present challenges, but not necessarily insurmountable ones. Some lenders specialize in loans for borrowers with less-than-perfect credit, though these often come with higher interest rates.

The history of credit scoring for loans, including boat loans, is intertwined with the rise of consumer credit. As lending became more common, the need for a standardized system to assess risk emerged. Today, FICO scores are the most widely used metric, considering factors like payment history, amounts owed, length of credit history, new credit, and credit mix. Understanding these factors can empower you to improve your creditworthiness before applying for a boat loan.

One of the main issues borrowers face regarding credit scores and boat loans is misinformation. Many believe a perfect score is necessary, which simply isn't true. Knowing the minimum acceptable score range for various lenders and loan types is essential. This knowledge helps borrowers realistically assess their options and prepare accordingly, including potentially improving their credit before applying.

A FICO score is a three-digit number representing your creditworthiness. For example, a score of 750 suggests a lower risk to lenders compared to a score of 600. Lenders use this score to determine your eligibility and loan terms. The higher the score, the more favorable the terms are likely to be.

A strong credit score when seeking a boat loan provides several benefits. First, it improves your chances of approval. Second, it can lead to lower interest rates, saving you significant money over the loan's lifetime. Third, a good credit score can give you access to more flexible repayment terms, allowing you to tailor your payments to your budget.

Boosting your credit score takes time and effort. Start by paying bills on time, every time. Reduce your credit utilization ratio by paying down existing debt. Avoid opening new credit accounts unnecessarily. Regularly check your credit report for errors and dispute any inaccuracies. By taking these steps, you can steer your credit in the right direction.

Before applying for a boat loan, check your credit report from all three major credit bureaus. Gather all necessary financial documentation, including proof of income and employment. Research various lenders and compare interest rates and loan terms. Determine a realistic budget and loan amount you can comfortably afford.

Advantages and Disadvantages of Having a Good Credit Score for a Boat Loan

| Advantages | Disadvantages |

|---|---|

| Lower interest rates | None, really! |

| Higher loan approval chances | |

| Better loan terms |

Best practice is to check your credit score regularly. Another is to pay your bills on time. Also, maintain a low credit utilization ratio. Research different lenders and compare loan terms before applying. Finally, create a realistic budget for your boat purchase and loan payments.

Real-world examples vary, but generally, individuals with scores above 700 often secure favorable loan terms. Those with scores in the mid-600s might still qualify but potentially with higher rates. Borrowers with lower scores may face challenges but can explore options like secured loans or lenders specializing in bad credit loans.

A common challenge is having a low credit score. The solution is to work on improving it before applying. Another challenge is finding the right lender. Research and compare lenders to find the best fit. Budgeting can be a challenge. Create a realistic budget and stick to it.

FAQs: What is the minimum credit score for a boat loan? It varies by lender, but generally, a higher score is better. How can I improve my credit score? Pay bills on time, reduce debt, and avoid opening new credit accounts unnecessarily. What documents are needed for a boat loan application? Proof of income, employment, and potentially asset information. What are the different types of boat loans? Secured and unsecured loans are common. How long does the boat loan application process take? It varies, but be prepared for several weeks.

A tip for securing a good boat loan is to shop around and compare offers from different lenders. Another trick is to consider a larger down payment to reduce the loan amount and potentially qualify for better terms. Negotiate interest rates and fees with lenders to get the best possible deal.

In conclusion, understanding the role of your credit score in securing a boat loan is paramount. While a perfect score isn't mandatory, a higher score significantly enhances your chances of approval and unlocks favorable terms, including lower interest rates and better repayment options. By taking proactive steps to improve your creditworthiness and making informed decisions throughout the loan application process, you can navigate the waters of boat financing with confidence and set sail towards realizing your dream of owning a boat. Don't let your credit score be an anchor weighing down your aspirations. Take control of your financial future and embark on the exciting journey of boat ownership. Begin by checking your credit score and researching lenders today. Your dream boat awaits!

Find your perfect fly fishing gear locally

Unleash your inner artist finding beautiful photos to draw

Sheng mai san the american dragon an exploration of cultural fusion