Unlocking the Power of Accounting Worksheets: Your Guide to Financial Clarity

In the intricate dance of debits and credits, one tool stands out as a powerful ally for both seasoned accountants and those just beginning their financial journey: the accounting worksheet, or as it's known in Spanish, hoja de trabajo en contabilidad. But what exactly is this crucial document, and why is it so essential for maintaining financial order?

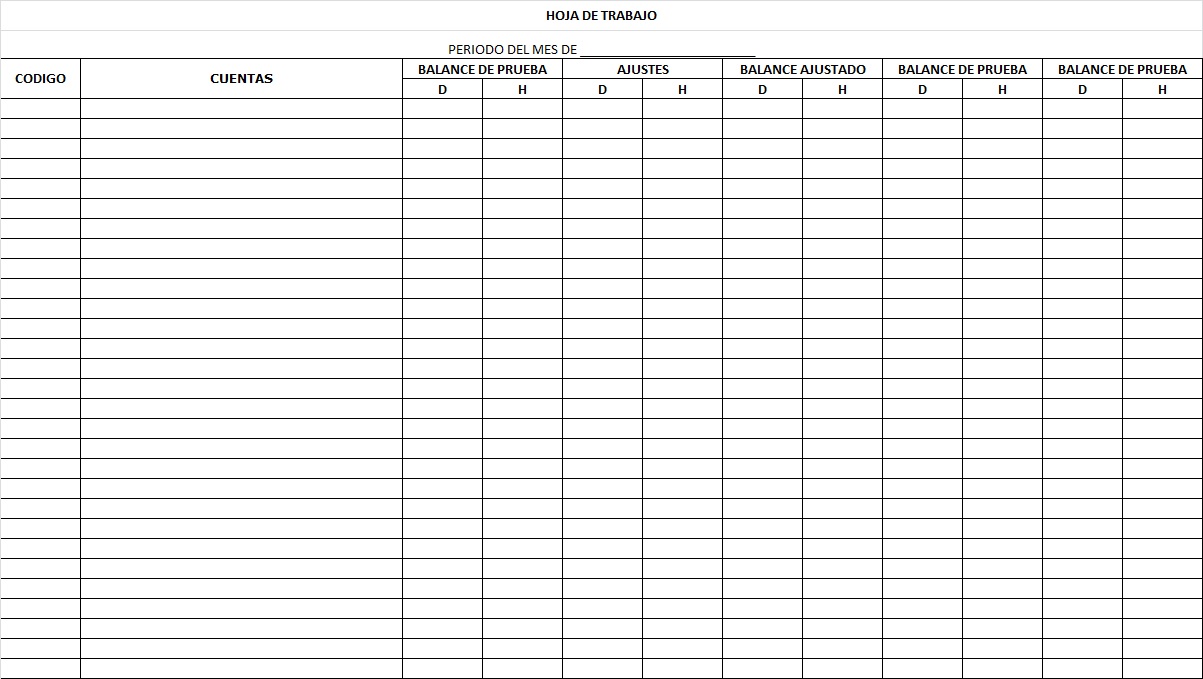

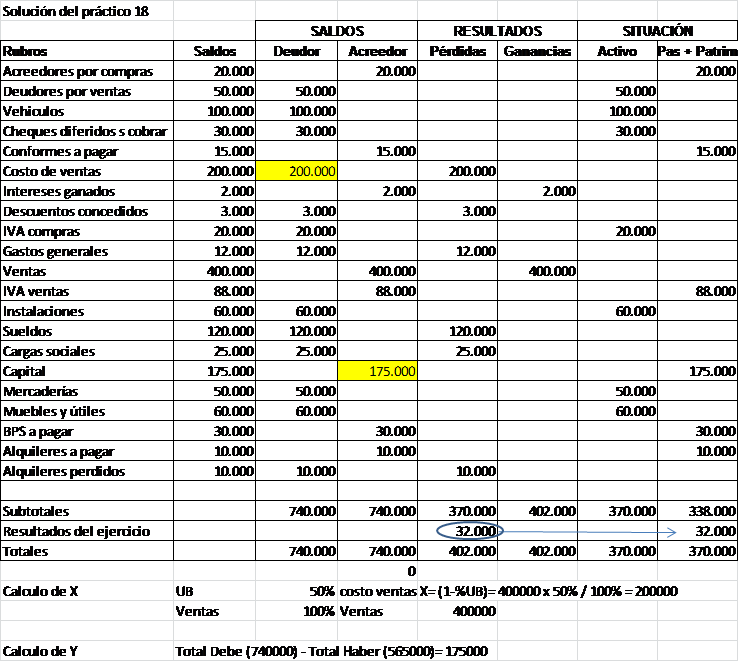

An accounting worksheet is a spreadsheet-like document used to organize and analyze financial data before preparing formal financial statements. Think of it as a behind-the-scenes staging area where you can meticulously review and adjust account balances before they make their official debut. It's a crucial step in the accounting cycle, bridging the gap between recording transactions and presenting the final financial picture.

Imagine trying to assemble a complex puzzle without first sorting the pieces. Similarly, attempting to create accurate financial statements without a worksheet can be a chaotic and error-prone process. The worksheet provides a structured environment for ensuring that the accounting equation – assets equal liabilities plus equity – remains balanced, and that all transactions have been properly accounted for.

While the precise origins of the accounting worksheet are difficult to pinpoint, its development is closely tied to the evolution of double-entry bookkeeping. As businesses became more complex, the need for a systematic method of summarizing and verifying financial information grew. The worksheet emerged as a solution, enabling accountants to perform crucial checks and balances before finalizing the books.

The importance of a worksheet cannot be overstated. It allows for the detection and correction of errors, facilitates the preparation of adjusting entries, and simplifies the creation of financial statements. This preliminary analysis is crucial for ensuring the accuracy and reliability of the information presented to stakeholders.

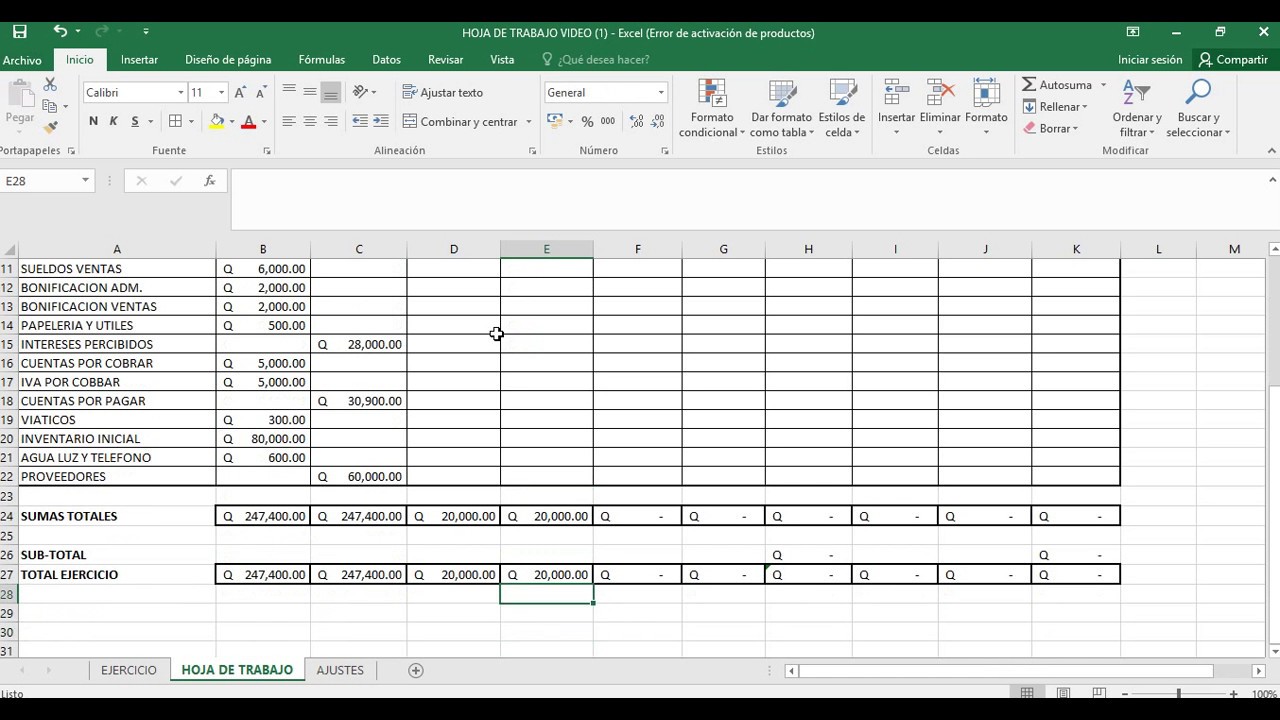

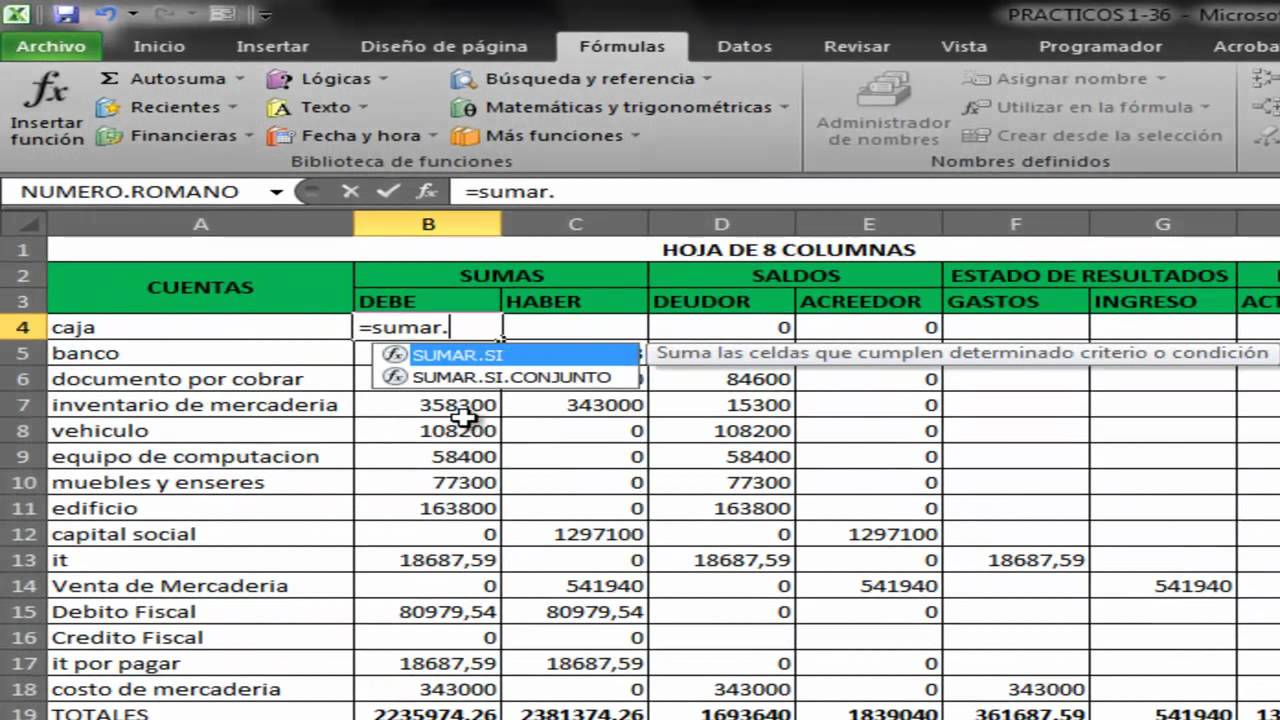

A worksheet typically consists of columns for trial balance figures, adjustments, adjusted trial balance, income statement, and balance sheet. It allows accountants to see the impact of adjusting entries on the final financial statements before those statements are actually prepared. For example, recording depreciation expense on an asset would involve an adjusting entry on the worksheet that decreases the asset's value and increases the depreciation expense.

Using a worksheet provides several key benefits. First, it improves accuracy by providing a structured format for reviewing and adjusting account balances. Second, it saves time by streamlining the process of preparing financial statements. Third, it enhances understanding of the financial position of a business by presenting a clear and organized overview of all relevant data.

A simple action plan for implementing worksheets involves incorporating them into the month-end or year-end closing process. Begin by preparing a trial balance, then analyze account balances for necessary adjustments. Record these adjustments on the worksheet, and then use the adjusted figures to prepare the financial statements.

Advantages and Disadvantages of Using Accounting Worksheets

| Advantages | Disadvantages |

|---|---|

| Improved Accuracy | Can be Time-Consuming for Simple Transactions |

| Streamlined Financial Statement Preparation | Potential for Errors if Not Used Carefully |

| Enhanced Understanding of Financial Position | May Not Be Necessary for Very Small Businesses |

Best practices for using worksheets include maintaining clear and concise labels, using formulas for calculations to minimize errors, and regularly reviewing and reconciling the worksheet data.

Challenges related to worksheets can include complexity for large businesses and potential for errors if not properly managed. Solutions involve utilizing accounting software and implementing robust internal controls.

Frequently Asked Questions:

1. What is an accounting worksheet? (Answered above)

2. Why are accounting worksheets important? (Answered above)

3. How do I create an accounting worksheet? (Answered above)

4. What are adjusting entries? (Adjusting entries are made at the end of an accounting period to update accounts and ensure accuracy.)

5. What is a trial balance? (A trial balance is a summary of all general ledger accounts and their balances.)

6. What are the main components of a worksheet? (Answered above)

7. Can I use software for creating accounting worksheets? (Yes, most accounting software includes worksheet functionality.)

8. What are some common errors to avoid when using worksheets? (Transposition errors, incorrect formulas, and omissions are common errors.)

Tips and tricks for using worksheets include utilizing spreadsheet software features like formulas and data validation, as well as color-coding for better organization.

In conclusion, the accounting worksheet, or hoja de trabajo en contabilidad, is an invaluable tool for maintaining accurate and reliable financial records. It provides a structured environment for analyzing and adjusting account balances, streamlining the process of preparing financial statements, and ensuring the overall financial health of a business. From small startups to large corporations, understanding and utilizing the power of the accounting worksheet is essential for achieving financial clarity and control. Embrace this powerful tool, and empower yourself to make informed financial decisions. By taking the time to understand and implement the principles outlined here, you’ll be well on your way to mastering your finances and achieving greater success in your business endeavors. Whether you're a seasoned accountant or just starting out, the accounting worksheet is a resource you can’t afford to overlook.

Navigating legal waters portland your guide

Unlocking urban living your guide to shop houses for sale

Unleash your inner music maestro conquer the name that song quiz