Unlocking Potential: The Bank Rakyat Angkasa Financing Form

Dreaming of owning a home? Looking for financial assistance to reach that goal? Bank Rakyat's Angkasa Financing program might be the key. This program, facilitated by the Angkasa Financing Form (Borang Angkasa Bank Rakyat), offers a unique opportunity for eligible individuals to secure financing for homeownership. But navigating the application process and understanding the intricacies of this program can feel daunting. This article will break it all down for you.

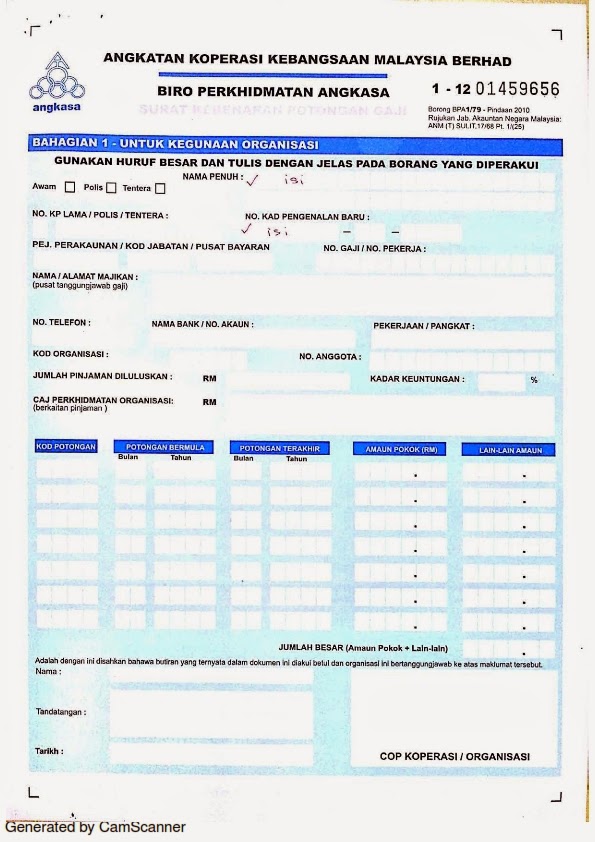

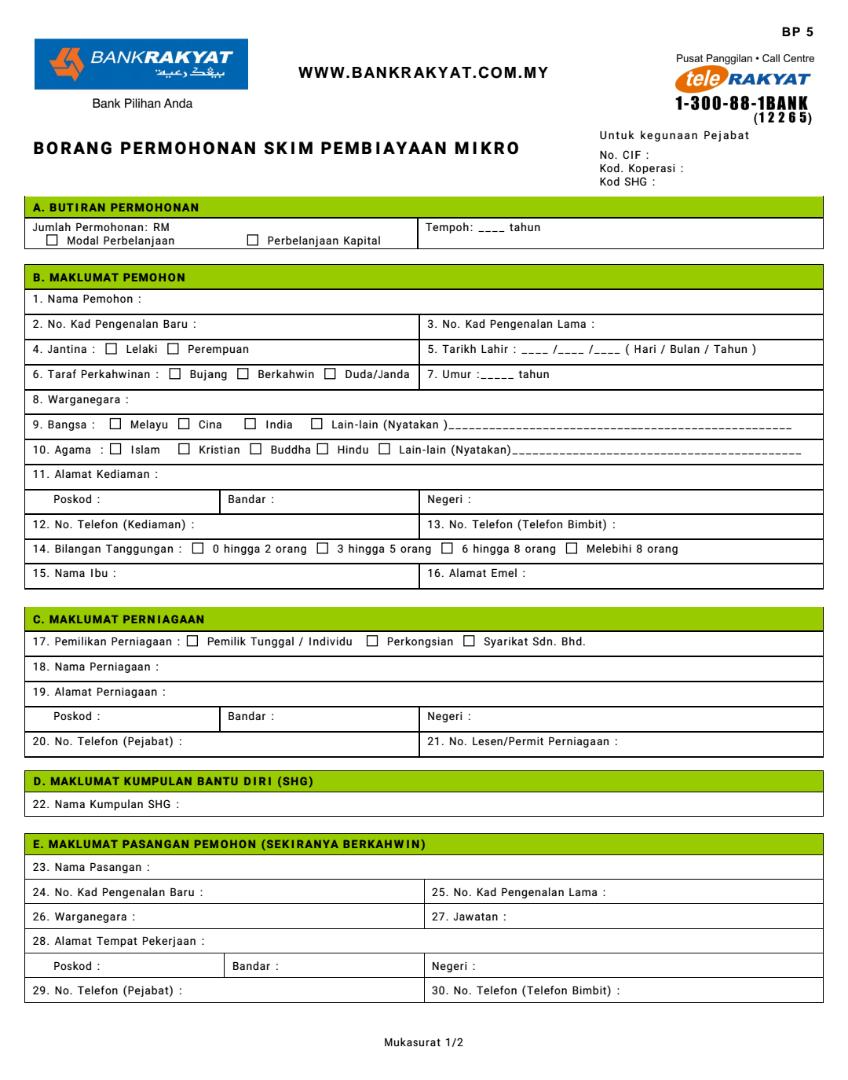

The Borang Angkasa Bank Rakyat, also known as the Angkasa Financing Application Form, is the essential document required to apply for this specific housing loan. It's the gateway to accessing financial support specifically designed for members of ANGKASA, the National Cooperative Movement of Malaysia Limited. Think of it as the first step in a journey towards realizing your homeownership aspirations. This form initiates the process of assessment and approval, connecting applicants with the potential to secure their dream property.

While the precise origins of the Angkasa Financing program are intertwined with the establishment and growth of ANGKASA itself, its primary purpose has always been to empower members through accessible financial solutions. Bank Rakyat, a cooperative bank, plays a crucial role in facilitating this program. The Borang Angkasa Bank Rakyat, as the application tool, reflects this collaborative effort to provide targeted financial aid for homeownership. This collaborative approach is a testament to the importance placed on supporting cooperative members in achieving their financial aspirations.

One of the core issues surrounding the Borang Angkasa Bank Rakyat, as with any financial application, is ensuring accurate and complete information. Incomplete or incorrect details can lead to delays or even rejection of the application. Understanding the required documentation, eligibility criteria, and the proper way to fill out the form is paramount. This article will shed light on these crucial aspects, making the application process smoother and more manageable. It’s about empowering you with the knowledge to navigate the system effectively.

Navigating financial forms can be challenging. With the Borang Angkasa Bank Rakyat, clarity is key. This form requests specific information about the applicant, their financial standing, and the desired property. This data allows Bank Rakyat to assess the applicant's eligibility and determine the appropriate financing options. Think of it as a detailed profile, showcasing your financial readiness and commitment to responsible homeownership. Providing accurate and comprehensive information streamlines the process and demonstrates your seriousness as a potential borrower.

One key benefit of using the Borang Angkasa Bank Rakyat is access to competitive financing rates specifically tailored for ANGKASA members. This can translate into significant savings over the lifetime of the loan. Another advantage is the potential for flexible repayment terms, allowing borrowers to structure their payments in a way that aligns with their financial capabilities. Finally, the program offers dedicated support and guidance throughout the application process, ensuring applicants are well-informed and confident in their decisions.

Frequently Asked Questions:

1. What is Borang Angkasa Bank Rakyat? It’s the application form for the Angkasa Financing program.

2. Who is eligible? Generally, ANGKASA members.

3. Where can I get the form? Bank Rakyat branches or potentially online.

4. What documents are needed? This will vary but often includes proof of income, identification, and property details.

5. How long does approval take? This can depend on various factors but expect a processing period.

6. What are the interest rates? Check with Bank Rakyat for current rates.

7. Can I apply online? This depends on Bank Rakyat’s current procedures.

8. What if my application is rejected? Inquire with Bank Rakyat about the reasons and potential next steps.Tips and tricks for a smoother application process include ensuring all information is accurate, gathering required documents beforehand, and contacting Bank Rakyat directly with any questions.

In conclusion, the Borang Angkasa Bank Rakyat represents a valuable opportunity for ANGKASA members seeking homeownership. While navigating the application process might seem complex, understanding the key requirements and benefits can significantly ease the journey. By utilizing the resources available and ensuring accurate completion of the Borang Angkasa Bank Rakyat, applicants can unlock the potential for securing their dream home. This program serves as a testament to the cooperative spirit and the power of collective action in achieving financial wellbeing. Take the first step today and explore the possibilities of Angkasa Financing.

Teenage fashion in the 80s a blast from the past

Dominate your draft unlocking the power of fantasy pros ppr rankings

El pais in english latest news spains pulse translated