Unlocking Peace of Mind: Navigating Wells Fargo Alerts

In our increasingly interconnected world, the ability to stay informed about our financial lives is paramount. The subtle hum of digital notifications has become the heartbeat of modern communication, a constant pulse of information vying for our attention. Amidst this cacophony, the quiet power of financial alerts emerges as a vital tool for safeguarding our economic well-being. Wells Fargo, like many financial institutions, offers an alert system designed to keep customers informed about their accounts. But how do we navigate this system effectively? How do we ensure that these crucial alerts cut through the noise and reach us when it matters most?

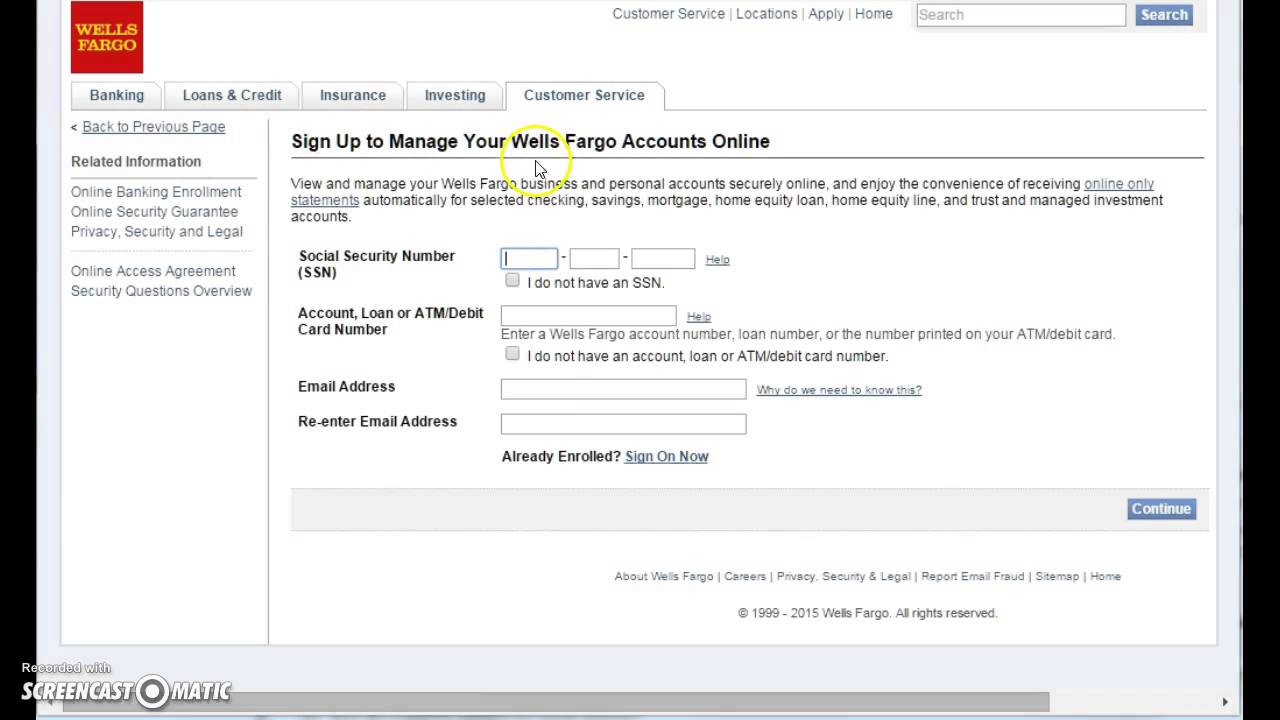

Accessing your Wells Fargo alerts begins with the simple act of signing on. This portal, often overlooked, is the gateway to a wealth of information about your financial activities. By logging into your Wells Fargo account, you gain access to a personalized dashboard of alerts tailored to your specific banking relationship. These alerts can range from notifications of deposits and withdrawals to warnings about potential fraud. The ability to view these alerts promptly allows you to stay on top of your finances and react swiftly to any unusual activity.

The history of banking alerts is intertwined with the evolution of technology itself. From the days of handwritten ledger entries and mailed statements, we have progressed to a world of instant notifications delivered directly to our devices. The rise of online banking paved the way for real-time alerts, transforming the way we interact with our financial institutions. Wells Fargo's alert system is a testament to this evolution, a modern manifestation of the age-old need for financial transparency and control.

The importance of regularly reviewing your Wells Fargo alerts cannot be overstated. These alerts serve as a crucial first line of defense against fraud. By notifying you of unusual transactions, they empower you to take immediate action, potentially preventing significant financial losses. Beyond fraud prevention, these alerts also provide valuable insights into your spending habits, enabling you to track your expenses and make informed financial decisions.

Accessing your Wells Fargo alerts is a straightforward process. First, navigate to the Wells Fargo website. Next, locate the "Sign On" button, typically found in the upper right-hand corner of the page. Enter your username and password, then click "Sign On" again. Once logged in, you should be able to easily locate the "Alerts" section, often represented by a bell or notification icon. Clicking on this icon will reveal a list of your recent alerts.

One of the key benefits of utilizing Wells Fargo alerts is the enhanced security they provide. By receiving immediate notifications of suspicious activity, you can quickly identify and address potential security breaches.

Another advantage is the improved financial management these alerts facilitate. By tracking your transactions in real-time, you can gain a clearer understanding of your spending patterns and make more informed budgeting decisions.

Furthermore, Wells Fargo alerts offer increased peace of mind. Knowing that you are constantly informed about your account activity allows you to relax and focus on other aspects of your life, secure in the knowledge that your finances are being monitored.

Advantages and Disadvantages of Wells Fargo Alerts

| Advantages | Disadvantages |

|---|---|

| Enhanced Security | Potential for Alert Fatigue |

| Improved Financial Management | Reliance on Technology |

| Increased Peace of Mind | Possible Delays in Alert Delivery |

Best Practices for Managing Wells Fargo Alerts: Regularly review your alert settings. Customize your alerts to match your specific needs. Respond promptly to any alerts you receive. Keep your contact information updated. Familiarize yourself with the different types of alerts available.

Frequently Asked Questions:

How do I sign on to view my Wells Fargo alerts? (Answer: Navigate to the Wells Fargo website, click "Sign On," enter your credentials, and locate the "Alerts" section.)

What types of alerts are available? (Answer: Alerts are available for a variety of account activities, including deposits, withdrawals, and potential fraud.)

How can I customize my alert settings? (Answer: You can typically customize your alert settings within the "Alerts" section of your online banking portal.)

What should I do if I receive a suspicious alert? (Answer: Immediately contact Wells Fargo customer service.)

Can I receive alerts on my mobile device? (Answer: Yes, you can typically configure your settings to receive alerts via email or text message.)

How often are alerts sent? (Answer: The frequency of alerts depends on the specific type of alert and your account settings.)

Are there any fees associated with Wells Fargo alerts? (Answer: Typically, there are no fees associated with receiving alerts.)

How can I turn off alerts? (Answer: You can usually disable alerts within the "Alerts" section of your online banking portal.)

Tips and Tricks: Regularly review your alert settings to ensure they align with your current needs. Take advantage of the customization options to tailor your alerts to your specific preferences. Consider setting up alerts for both large and small transactions to maintain a comprehensive overview of your account activity.

In conclusion, the ability to access and manage your Wells Fargo alerts is a crucial aspect of modern financial management. By signing on to view your alerts, you empower yourself with the knowledge and tools necessary to safeguard your financial well-being. From enhanced security and improved financial management to increased peace of mind, the benefits of utilizing this service are undeniable. While challenges such as alert fatigue and reliance on technology may arise, the advantages significantly outweigh the drawbacks. Embracing the power of Wells Fargo alerts is a proactive step towards achieving financial security and control in an increasingly complex digital landscape. By taking the time to familiarize yourself with the system, customize your settings, and respond promptly to notifications, you can harness the full potential of this valuable tool and navigate the financial world with confidence and peace of mind. Take control of your financial well-being today – sign on to view your Wells Fargo alerts and unlock the peace of mind that comes with staying informed.

Dave po box 71402 salt lake city ut 84171

Luke combs milwaukee ticketmaster your ultimate guide

What are some cute usernames unleash your inner adorable online