Unlocking Financial Access: Navigating the World of Bank Account Verification Letters

In an increasingly digital world, the ability to participate in the global economy often hinges on something seemingly simple: a bank account. Whether it's for receiving salaries, transacting business, or accessing financial services, a bank account is often the gateway. However, the process of opening and verifying these accounts, especially across different countries and languages, can be a significant hurdle. This is where understanding the role of documentation like a "contoh surat pengesahan buka akaun bank" becomes essential.

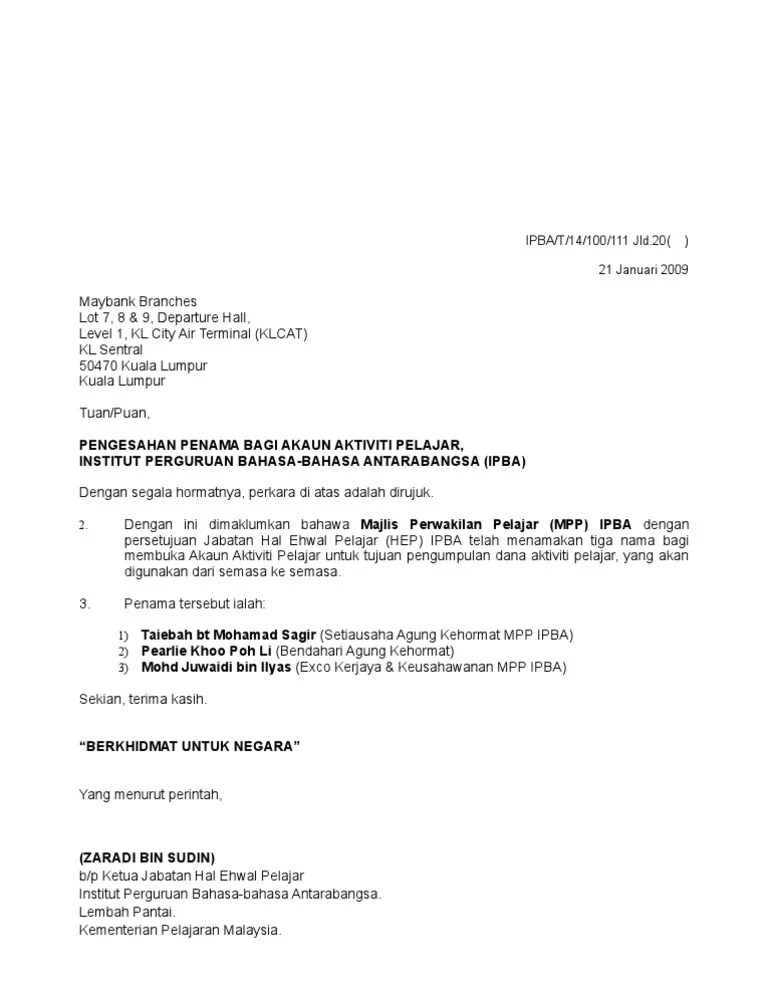

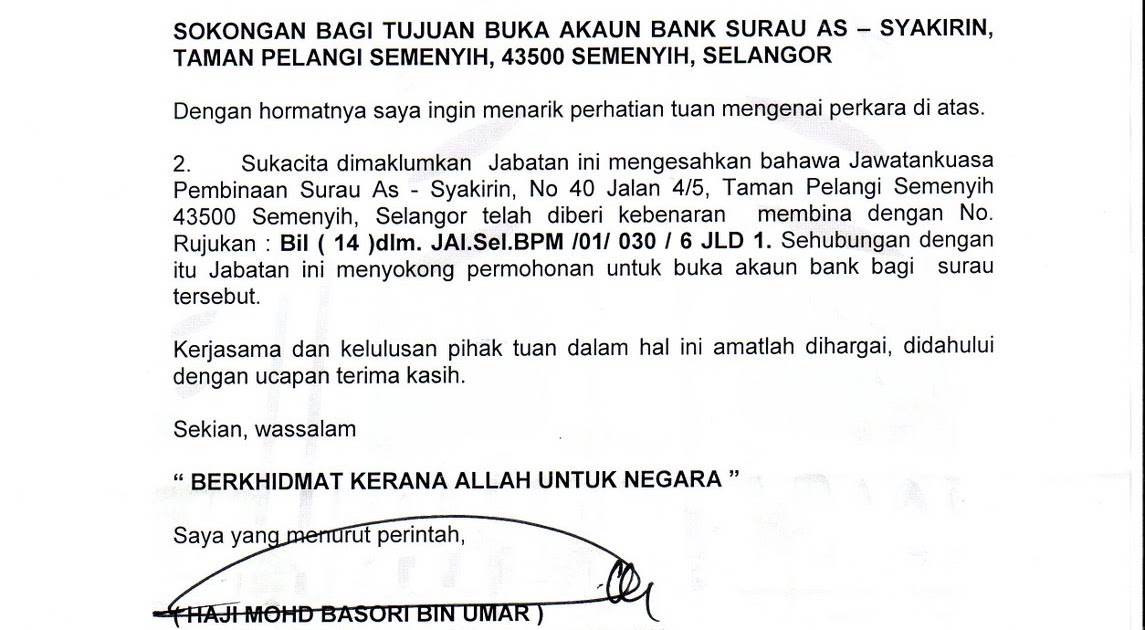

The phrase "contoh surat pengesahan buka akaun bank" translates from Malay to English as "sample letter of confirmation for opening a bank account." While it may sound like bureaucratic jargon, this type of document plays a crucial role in building trust and security within the financial system. It serves as a standardized format, ensuring that individuals and businesses meet specific requirements when seeking access to financial services.

The history and evolution of such documents are intertwined with the development of banking itself. As financial institutions grew more complex, so did the need for standardized procedures to combat fraud and maintain order. These letters represent a critical step in that evolution, providing a tangible record of the verification process.

The importance of these verification letters cannot be overstated. In a world grappling with issues like money laundering and identity theft, they act as a safeguard, protecting both the individual and the financial institution. By requiring specific documentation and adhering to established formats, banks can more confidently verify the identities of their customers and ensure the legitimacy of their transactions.

However, navigating the intricacies of these requirements, especially when dealing with different languages and regional variations, can be confusing. What constitutes valid proof of address in one country might not be accepted in another. The format and content of a verification letter can also vary significantly, making it essential to understand the specific requirements of the bank and country in question.

To shed light on this process, let's delve into a practical example. Imagine a student from Malaysia wanting to study abroad. To manage their finances while overseas, they need to open a bank account in the new country. The bank, in compliance with its regulations, requires a "proof of address" document. In this situation, the student might need to request their Malaysian bank to issue a formal letter confirming their address, translated into the language of the new country. This letter, serving as the "contoh surat pengesahan buka akaun bank," bridges the gap between different systems and languages, enabling the student to access essential financial services.

While the specific requirements and procedures can vary, the underlying principle remains the same: establishing trust and transparency in an increasingly interconnected financial landscape. Understanding the role and importance of these verification documents is crucial for anyone looking to participate fully in the modern global economy.

Contagious cuteness the enduring allure of the cute cat gif kawaii

Unlocking creativity your guide to the humbrol acrylic colour chart

Unlocking the potential your guide to the used gm 36 v6 engine