Understanding JPMorgan Chase Domestic Wire Routing Numbers

Moving money quickly and securely within the United States often relies on wire transfers. Understanding the role of routing numbers is essential for these transactions. This article focuses on JPMorgan Chase's domestic wire routing numbers and provides a comprehensive overview of their significance, usage, and related considerations.

A routing number acts like an address for your bank. When you initiate a wire transfer, this number directs the funds to the correct financial institution. For JPMorgan Chase customers, having the correct domestic wire routing number is paramount for successful transfers within the US.

Imagine sending a letter without a proper address. It likely won't reach its destination. Similarly, using the wrong routing number can delay or even prevent your wire transfer from being processed correctly. This underscores the importance of having accurate information.

Several factors contribute to the complexity of routing numbers. Mergers and acquisitions in the banking industry can lead to multiple routing numbers for a single institution, often based on geographical location or the type of account. For JPMorgan Chase, this means different routing numbers may apply depending on where you opened your account.

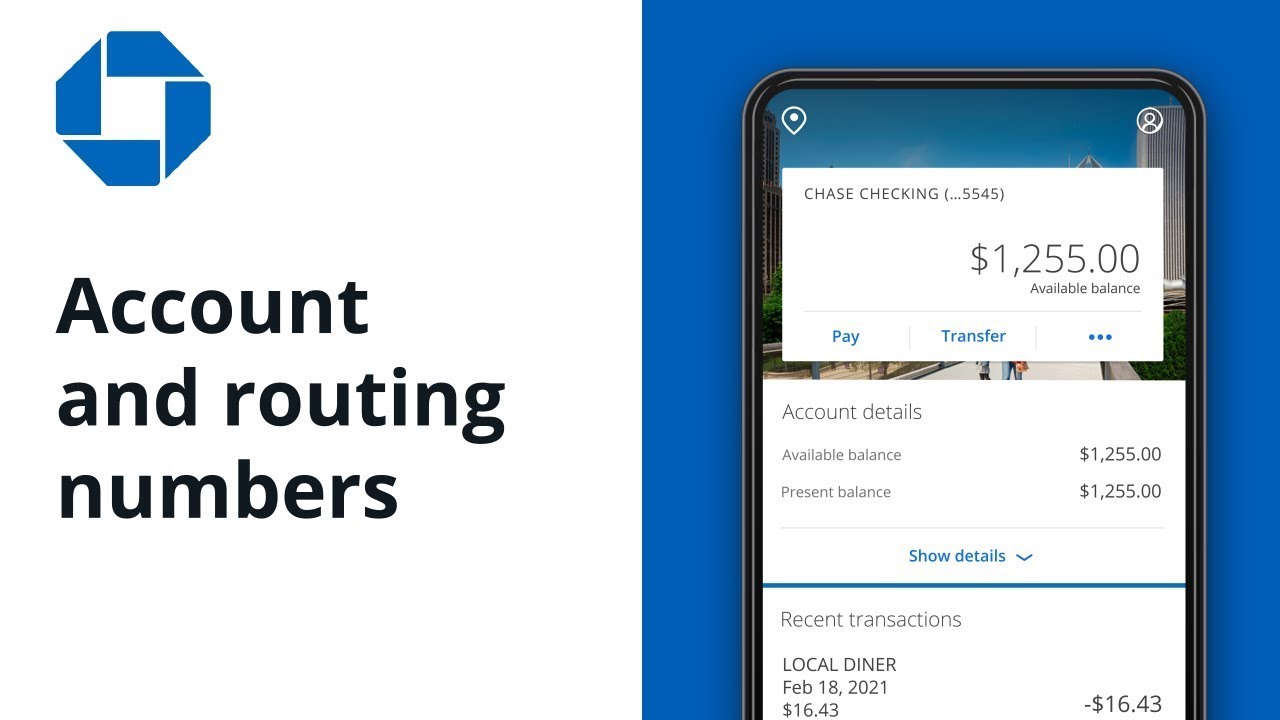

Finding the right JPMorgan Chase domestic wire routing number requires careful attention. Checking your personal checkbook, online banking portal, or contacting customer support are reliable ways to obtain this crucial information. Using an outdated or incorrect number can lead to significant delays and potential complications.

The history of routing numbers is intertwined with the development of the US banking system. These numbers were established to streamline interbank transactions, facilitating the efficient movement of funds across different institutions. The American Bankers Association (ABA) developed the system in 1910.

One key difference between a domestic wire routing number and other routing numbers is their specific application to transactions within the United States. International wire transfers require different SWIFT codes, adding another layer of complexity to global transactions.

Locating your JPMorgan Chase domestic wire routing number can be done through several channels. Your personal checks usually display the number in the bottom left corner. Alternatively, logging into your online banking account or contacting customer support are effective methods for retrieving this information.

A simple example: Imagine sending a wire transfer to a friend's JPMorgan Chase account. You'll need their account number and the correct JPMorgan Chase domestic wire routing number to ensure the funds reach their intended destination.

Benefit 1: Speed. Wire transfers are generally faster than other methods of transferring money domestically.

Benefit 2: Security. Wire transfers offer a secure way to move large sums of money.

Benefit 3: Traceability. The electronic nature of wire transfers provides a clear record of the transaction.

Action Plan for Sending a Wire Transfer:

1. Gather the recipient's account number and the correct JPMorgan Chase domestic wire routing number.

2. Initiate the wire transfer through your bank, either online or in person.

3. Verify the transfer details before confirming.

Tips and Tricks: Double-check all information before initiating a wire transfer. Keep records of your transactions for future reference. Contact JPMorgan Chase customer support if you have any questions or encounter any issues.

Advantages and Disadvantages

| Advantages | Disadvantages |

|---|---|

| Speed and Efficiency | Cost (typically higher than other transfer methods) |

| Security | Irreversible (errors can be difficult to rectify) |

| Traceability | Requires accurate information (routing number, account number) |

FAQ:

1. What is a JPMorgan Chase domestic wire routing number? - A code that identifies the bank for US transfers.

2. Where can I find my routing number? - Checkbook, online banking, customer support.

3. What if I use the wrong routing number? - The transfer may be delayed or rejected.

4. Is my routing number the same for all transactions? - Not necessarily, it depends on account type and location.

5. Are wire transfers safe? - Generally secure, but precautions should be taken.

6. How long does a domestic wire transfer take? - Usually within the same business day.

7. What is the difference between a domestic and international wire transfer? - Domestic uses routing numbers, international uses SWIFT codes.

8. How much does a wire transfer cost? - Varies depending on the bank and amount transferred.

In conclusion, understanding the function and importance of the JPMorgan Chase domestic wire routing number is crucial for smooth and successful US transfers. Taking the time to locate and verify this information is a small step that can save you significant time and potential headaches. The benefits of speed, security, and traceability make wire transfers a valuable tool for moving money, but accuracy is paramount. Always double-check your information, keep records of your transactions, and don't hesitate to reach out to JPMorgan Chase for assistance. By prioritizing accuracy and understanding the process, you can confidently utilize wire transfers for your financial needs.

Cek tiket kereta cepat your ticket to high speed rail in indonesia

Transform your bathroom with stylish shower doors for tubs ideas

The enduring mark exploring the world of indelible ink pens