Transit Number Treasure Hunt: Unlocking Your Financial Coordinates

Ever felt like a digital Indiana Jones, hunting for that elusive transit number? It's that crucial piece of the puzzle that unlocks smooth financial transactions, but finding it can sometimes feel like navigating a booby-trapped temple. Don't worry, you don't need a whip and a fedora. This guide is your map to unearthing your financial coordinates.

So, what exactly *is* this magical transit number everyone's after? In the world of banking, your transit number, also known as a routing transit number (RTN), identifies your specific financial institution. Think of it as your bank's unique fingerprint. It's a nine-digit code that directs electronic payments and deposits to the right place, ensuring your money ends up where it's supposed to.

The history of transit numbers goes back to the early 20th century, when the American Bankers Association (ABA) developed the system to streamline check processing. Before transit numbers, manually sorting and routing checks was a monumental task. The introduction of these numerical identifiers revolutionized the banking industry, paving the way for the automated systems we rely on today.

Locating your bank transit number is crucial for various financial transactions. Setting up direct deposit, sending wire transfers, or even paying bills online often requires this vital code. Without it, your transactions could be delayed or even rejected. Understanding how to access this information is essential for navigating today's digital financial landscape.

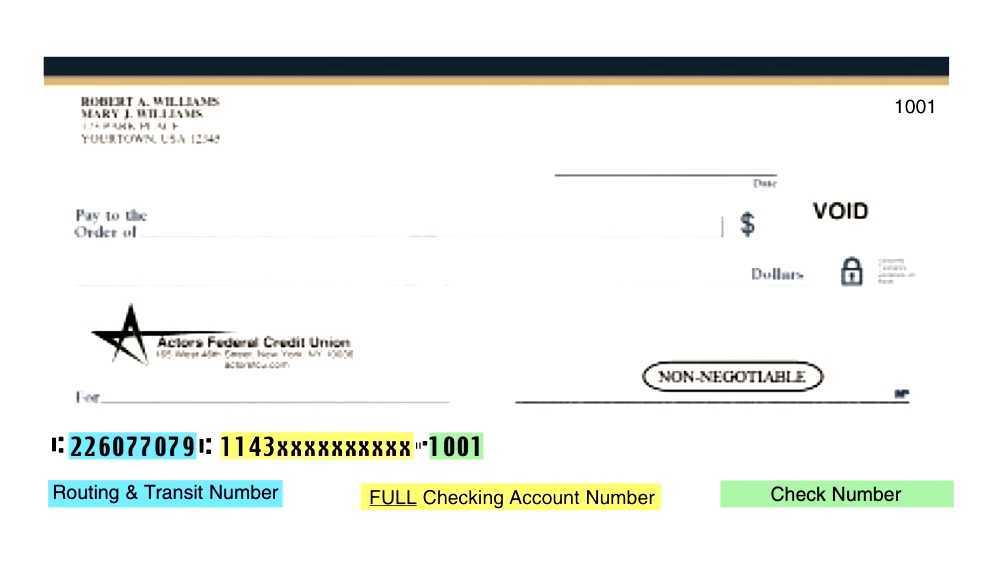

One of the most common places to find your transit number is on your checks. Typically, it's the first set of nine digits printed at the bottom left corner. It’s often accompanied by other important numbers, like your account number and the check number. But with the rise of online banking, many people don’t use checks anymore. So where else can you find this essential piece of information?

Your online banking portal is usually a reliable source. Look for a section labeled "Account Details," "Bank Information," or something similar. Often, your transit number will be displayed alongside other account information. You might also find it on your monthly bank statements, typically printed at the top or bottom of the page.

If all else fails, contacting your bank directly is always an option. A customer service representative can readily provide your transit number. This direct method guarantees accuracy and provides an opportunity to clarify any related banking questions you may have.

One benefit of knowing where your transit number is located is the convenience it offers for electronic transactions. For instance, setting up direct deposit for your paycheck requires this information, allowing funds to be transferred directly into your account without any manual intervention.

Another advantage is the ability to make online bill payments. By providing the correct transit number along with your account information, you can authorize secure and timely payments to various service providers, simplifying your financial management.

Finally, knowing your transit number is crucial for wire transfers. Whether you're sending money internationally or domestically, providing accurate bank details, including the transit number, ensures the smooth and successful completion of the transfer.

Advantages and Disadvantages of Knowing Your Transit Number

| Advantages | Disadvantages |

|---|---|

| Facilitates electronic transactions | Potential for misuse if shared with unauthorized individuals |

| Enables efficient bill payments | Requires careful storage to prevent identity theft |

| Essential for wire transfers |

Best Practices for Protecting Your Transit Number:

1. Avoid sharing your transit number over unsecured email or phone calls.

2. Store your checkbook and bank statements securely.

3. Regularly monitor your bank accounts for unauthorized transactions.

4. Be cautious of phishing scams that attempt to trick you into revealing your banking information.

5. Shred any documents containing your transit number before discarding them.

FAQ:

1. What is a transit number used for? - It identifies your bank for electronic transactions.

2. Where can I find my transit number online? - Check your online banking portal under "Account Details."

3. Is my transit number the same as my account number? - No, they are different numbers serving different purposes.

4. What if I can't find my transit number? - Contact your bank's customer service.

5. Can I use my transit number to receive international payments? - Yes, along with other necessary banking details.

6. How many digits is a transit number? - Nine digits.

7. Is my transit number confidential? - Yes, treat it as sensitive information.

8. Can my transit number change? - It can change due to bank mergers or acquisitions, but you'll be notified.

In conclusion, understanding where to find your transit number and its significance empowers you to navigate the complexities of modern banking. Whether you're setting up direct deposit, making online payments, or sending wire transfers, having this crucial piece of information readily available simplifies your financial life. By following best practices for protecting this sensitive data, you can ensure the security of your financial transactions and maintain control over your funds. Take the time to familiarize yourself with the various methods of accessing your transit number, and don't hesitate to contact your bank if you have any questions. Your financial well-being depends on it.

Kickstart your weekend embrace the schonen start ins wochenende vibe

Navigating your next chapter a guide to federal benefits for military retirees

Unveiling the monstrous the power of description in storytelling