The Unseen Cost: Understanding Accrued Interest

Ever feel like you're trapped in a financial labyrinth? Like there's an invisible force working against your efforts to climb out of debt? That force might be accrued interest, the silent yet potent factor that can significantly inflate the cost of borrowing. Understanding this concept is crucial for anyone who uses credit cards, takes out loans, or invests in interest-bearing accounts.

Accrued interest, or "bunga yang masih harus dibayar" in Indonesian, is the interest that has accumulated on a principal balance but hasn't yet been paid. Think of it like a snowball rolling downhill, gathering more snow (interest) as it goes. This "snowball" grows larger each day until you make a payment. Ignoring it can lead to a significantly larger debt burden than you anticipated.

The history of interest dates back to ancient civilizations, where it was often viewed with suspicion, even considered usury. Over time, the practice evolved, becoming a fundamental component of modern finance. Today, interest is the engine that drives lending and borrowing, allowing individuals and businesses to access capital while compensating lenders for the risk they take.

The importance of understanding accrued interest lies in its impact on your financial health. Unpaid interest gets added to your principal balance, which means you end up paying interest on interest – a phenomenon known as compounding. This can quickly turn a manageable debt into a significant financial burden. Knowing how accrued interest works empowers you to make informed decisions about borrowing and investing, helping you avoid costly surprises.

One of the main issues surrounding accrued interest is its lack of visibility. Unlike a fixed monthly payment, accrued interest can fluctuate depending on the interest rate and the outstanding principal. This can make it difficult to track and budget for, especially if you have multiple loans or credit cards. This lack of transparency can lead to unexpected increases in debt and make it harder to plan for long-term financial goals.

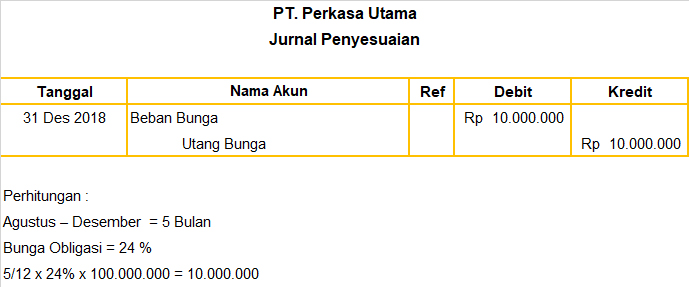

Accrued interest is calculated by multiplying the principal balance by the interest rate and the time period. For example, if you have a $1,000 loan with a 10% annual interest rate, the accrued interest after one month would be approximately $8.33. This amount is added to your principal balance, resulting in a new balance of $1,008.33.

One benefit of understanding accrued interest is the ability to minimize its impact. By making larger payments, or more frequent payments, you reduce the principal balance faster, thereby reducing the amount of interest that accrues. Another benefit is improved budgeting. Once you grasp how accrued interest accumulates, you can factor it into your budget, avoiding unexpected expenses and achieving financial stability.

Managing your outstanding interest requires proactive strategies. Create a detailed budget that tracks all your debt and interest payments. Explore options for consolidating high-interest debt into lower-interest loans. Prioritize paying off high-interest debt first to minimize the overall cost of borrowing. Regularly review your credit reports to ensure accuracy and stay informed about your outstanding balances.

Accrued interest can be a double-edged sword. On one hand, it allows lenders to earn a return on their investment, facilitating the flow of capital in the economy. On the other hand, if not managed carefully, it can become a significant burden for borrowers.

Advantages and Disadvantages of Accrued Interest

| Advantages | Disadvantages |

|---|---|

| Enables lenders to earn a return. | Increases the overall cost of borrowing. |

| Facilitates the flow of capital. | Can lead to a debt spiral if not managed carefully. |

Here are some frequently asked questions about accrued interest:

1. What is accrued interest? - It's the accumulated unpaid interest on a loan.

2. How is it calculated? - Principal x Interest Rate x Time Period.

3. Why is it important? - It affects the total cost of borrowing.

4. How can I minimize it? - Make larger or more frequent payments.

5. What happens if I don’t pay it? - It gets added to the principal.

6. How does it relate to compounding? - Unpaid interest earns more interest.

7. Where can I find more information? - Consult financial advisors or online resources.

8. Is accrued interest always bad? - Not necessarily; it's crucial to understand it.

One tip for managing accrued interest is to automate your payments. Setting up automatic payments ensures you never miss a due date, reducing the risk of accumulating more interest. Another trick is to make bi-weekly payments instead of monthly payments. This can help you pay down your principal faster and reduce the total amount of interest paid over the life of the loan.

In conclusion, understanding accrued interest, or "bunga yang masih harus dibayar," is a vital skill for navigating the complexities of personal finance. By grasping the mechanics of how interest accumulates, the factors that influence it, and the strategies for managing it, you can empower yourself to make informed borrowing decisions, minimize unnecessary costs, and achieve your financial goals. Remember, knowledge is power, especially when it comes to managing your finances. Take control of your debt, minimize the impact of accrued interest, and pave the way for a brighter financial future. Start by reviewing your current loans and credit cards, calculate your accrued interest, and create a plan to manage it effectively. Don't let the silent snowball of accrued interest bury you under a mountain of debt.

Designed for divine delight exploring gods good pleasure

Decoding the hype an in depth look at anine bing boots

Unlocking your earning potential the dg44 salary scale in malaysia