Taming Your Invoice Chaos: The Power of Spreadsheets

In the fast-paced world of business, every second counts, and nothing throws a wrench in the gears like disorganized finances. Whether you're a freelancer juggling multiple projects or a small business owner navigating the complexities of growth, keeping track of invoices can feel like a Sisyphean task. That's where the humble spreadsheet, a powerful yet often underestimated tool, steps in to save the day.

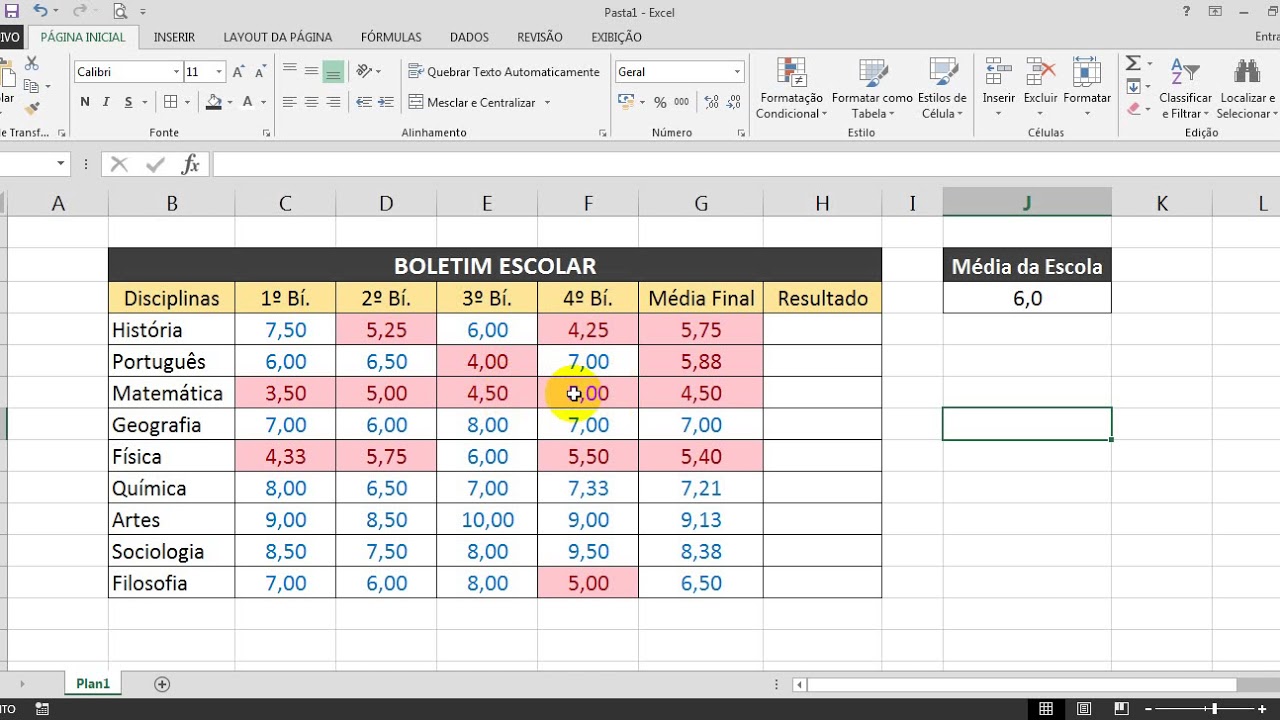

Imagine this: you send out an invoice, confident in the knowledge that you'll be paid on time. But then, weeks turn into months, and the payment remains elusive. Sound familiar? Without a robust system for tracking your invoices, it's easy to lose track of who owes you what, leading to delayed payments, cash flow crunches, and even strained client relationships. This is where an organized, detailed "planilha de notas emitidas" (Portuguese for "issued invoices spreadsheet") becomes your secret weapon.

A well-structured invoice spreadsheet acts as a centralized command center for all your billing needs. It's more than just a list of numbers; it's a dynamic tool that allows you to track invoice numbers, issue dates, due dates, payment status, and even client contact information. By meticulously logging every detail, you transform a potential administrative nightmare into a streamlined process, ensuring timely payments and giving you back the time and mental bandwidth to focus on what truly matters: growing your business.

While the concept of using spreadsheets for financial management has been around for decades, the digital age has supercharged their potential. Cloud-based spreadsheet software, with its collaborative features and real-time updates, allows for seamless teamwork and eliminates the risk of version control issues. Imagine: you're on the go, and a client inquires about the status of their payment. Armed with your trusty invoice spreadsheet (accessible from any device with an internet connection), you can instantly pull up the relevant information and provide an update, all within seconds. No more frantic searches through email threads or paper trails.

The benefits extend beyond mere organization. By analyzing the data captured in your invoice spreadsheet, you gain invaluable insights into your business's financial health. You can identify trends in payment patterns, anticipate potential cash flow gaps, and make informed decisions about pricing, budgeting, and even client acquisition strategies. In essence, your invoice spreadsheet evolves from a reactive tool to a proactive instrument that empowers you to make data-driven decisions and steer your business toward sustainable growth.

Now, let's delve into the practicalities of creating and utilizing an efficient invoice spreadsheet. While the exact structure can be tailored to your specific needs, there are some fundamental elements that every effective spreadsheet should include:

Advantages and Disadvantages of using Spreadsheets for Invoice Management

| Advantages | Disadvantages |

|---|---|

| Cost-effective and readily available | Manual data entry prone to errors |

| Highly customizable to specific needs | Limited automation capabilities compared to dedicated software |

| Easy to learn and use, even for beginners | Scalability issues as business grows |

| Provides a clear overview of outstanding invoices | Security risks, especially if not stored securely |

While spreadsheets offer a great starting point for managing your invoices, remember that they may not be a one-size-fits-all solution, especially as your business grows. Consider exploring dedicated invoicing software that offers more robust features like automated invoice generation, payment reminders, and integrated payment gateways.

In conclusion, mastering the art of invoice management is crucial for any business aiming to thrive in today's competitive landscape. Whether you choose to wield the power of spreadsheets or opt for more specialized software, the key takeaway remains the same: prioritize organization, leverage technology to streamline your processes, and watch your business flourish.

Langston hughes enduring impact on american literature

Designing a dream quinceanera silueta caricatura quinceanera animada png

Navigating loss understanding ripley funeral home ripley ms services