Stay on Top of Your Finances: A Guide to Checking Your PTPTN Monthly Payments (Cara Semak Bayaran Bulanan PTPTN)

Navigating the world of student loans can be tricky, especially when it comes to understanding repayment terms and managing your finances responsibly. For many Malaysians, the National Higher Education Fund Corporation (PTPTN) loan has been instrumental in funding their tertiary education. However, once the excitement of graduation fades, the reality of loan repayment sets in. Knowing how much you owe and staying on top of your monthly payments is crucial to avoid late fees and potential issues down the line.

This comprehensive guide focuses on "cara semak bayaran bulanan PTPTN" - the process of checking your monthly PTPTN loan payments. We'll delve into the importance of this practice, explore various methods to check your payments, and provide essential tips for seamless loan management.

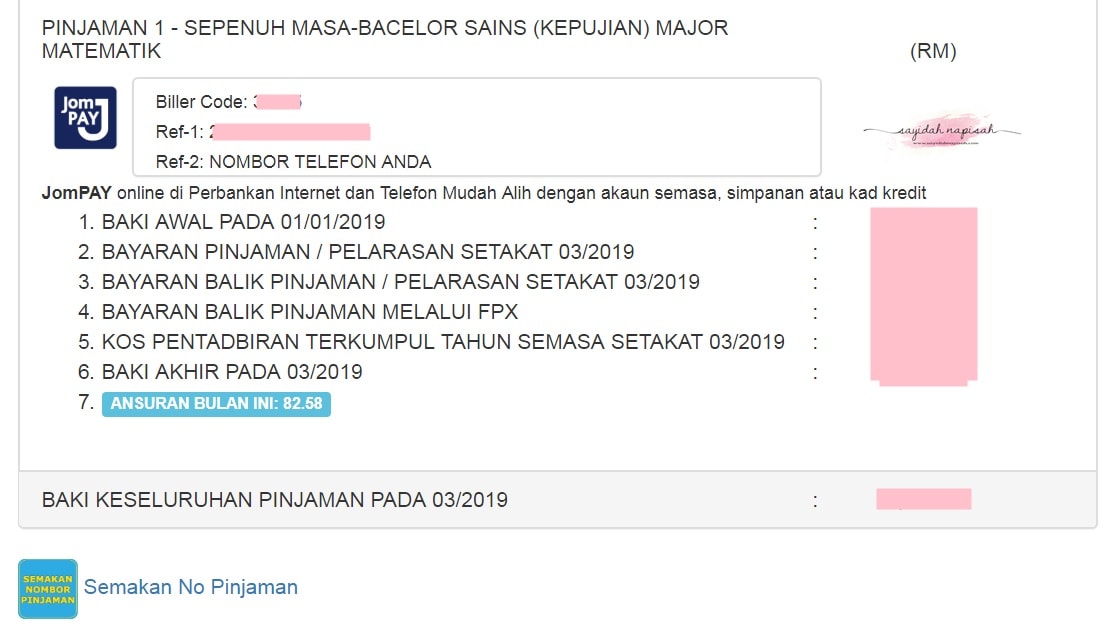

Before diving into the "how-to," it's crucial to understand the significance of regular payment checks. Imagine this: you've been diligently paying your monthly dues, only to discover later that some payments weren't processed correctly, leading to penalties and increased debt. Regular checks act as a safety net, allowing you to identify discrepancies early on and address them promptly. This proactive approach not only saves you money but also provides peace of mind, knowing you're on track with your financial obligations.

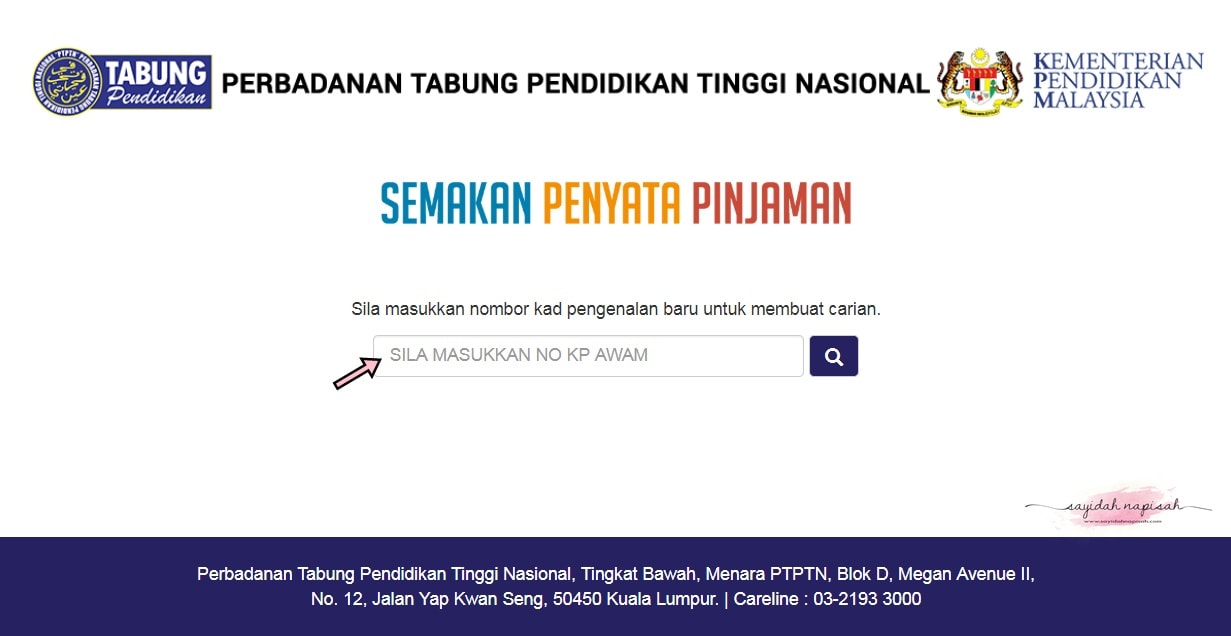

Now, let's explore the various methods available for checking your monthly PTPTN loan payments. Thankfully, PTPTN offers several convenient options, catering to different preferences and lifestyles. From the user-friendly online portal to mobile apps and SMS services, you can choose the method that best suits your needs. Each method comes with its own set of advantages, ensuring accessibility and convenience for all borrowers.

In today's digital age, managing your finances is no longer a daunting task. By embracing technology and utilizing the available resources, you can easily stay on top of your PTPTN loan repayments. Remember, taking charge of your financial well-being starts with being informed and proactive.

Advantages and Disadvantages of Regularly Checking PTPTN Loan Payments

Regularly checking your PTPTN loan payments offers numerous advantages, empowering you to take control of your financial well-being. Here's a closer look at the benefits and potential drawbacks:

| Advantages | Disadvantages |

|---|---|

| Early detection of payment errors or discrepancies | Time commitment required for regular checks |

| Avoidance of late fees and penalties | Potential for anxiety if discrepancies are found |

| Improved credit score by maintaining a positive payment history | |

| Peace of mind and reduced financial stress |

As you can see, the advantages of regular checks far outweigh the minimal drawbacks. By investing a small amount of time, you can reap significant long-term benefits, ensuring a healthy financial future.

In conclusion, understanding your PTPTN loan obligations and staying proactive with your payments is crucial for financial well-being. By embracing the "cara semak bayaran bulanan PTPTN" methods and incorporating regular checks into your routine, you can effectively manage your loan, avoid potential issues, and pave the way for a brighter financial future.

Decoding pennsylvania state employee compensation afscmes role

The smith jones and williams of it all why english last names are so weird

Unveiling the core theme of sa aking mga kabata love for ones native language