Semak No Cukai Pendapatan Online: Your Guide to Easy Tax Management

Taxes. It's the word that can make even the calmest person feel a little flustered. But what if I told you that managing your income tax in Malaysia doesn't have to be a headache? Thanks to the digital world, "semak no cukai pendapatan online" – the ability to check and manage your income tax online – has become a reality, simplifying the entire process and giving you back valuable time and peace of mind.

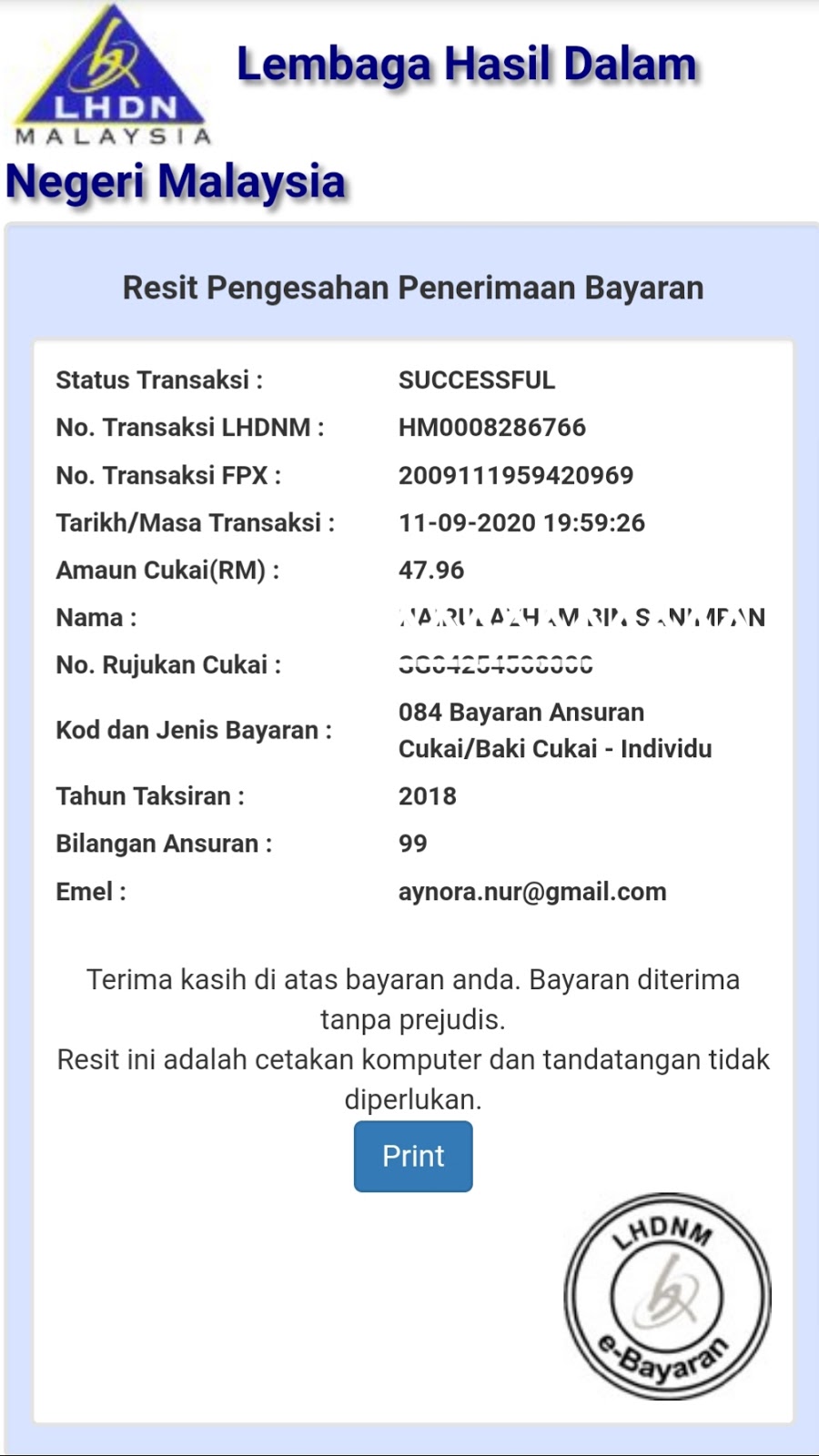

Gone are the days of paper forms, long queues, and endless phone calls to the Lembaga Hasil Dalam Negeri (LHDN). With just a few clicks, you can access your tax information, file your returns, make payments, and even track your refund status – all from the comfort of your home or office.

But before we dive into the "how-to," let's take a step back. For those unfamiliar with the Malaysian tax system, "semak no cukai pendapatan online" might seem like a mouthful. In essence, it refers to the online platform provided by LHDN that allows taxpayers to interact with the tax authority digitally.

The introduction of online tax management has been a game-changer in Malaysia. It reflects the government's commitment to leveraging technology to improve public services, making them more accessible and user-friendly. For taxpayers, this shift translates to increased convenience, reduced paperwork, and faster processing times.

While the concept of online tax management is relatively new, gaining traction within the last decade, it has quickly become the preferred method for millions of Malaysians. This rapid adoption speaks volumes about its effectiveness in simplifying a traditionally complex process, making tax season a little less daunting for everyone.

Advantages and Disadvantages of Semak No Cukai Pendapatan Online

| Advantages | Disadvantages |

|---|---|

| Convenience of managing taxes anytime, anywhere | Requires internet access and basic computer skills |

| Faster processing times for returns and refunds | Potential for technical issues or website downtime |

| Reduced paperwork and less need for physical documents | Security concerns related to personal and financial data |

| Easy access to past tax records and information | Limited support for complex tax situations |

Best Practices for Using Semak No Cukai Pendapatan Online

To make your online tax management experience even smoother, keep these best practices in mind:

- Keep Your Information Updated: Ensure your personal and contact details are always current on the LHDN portal.

- Choose a Strong Password: Protect your account with a unique and complex password.

- File On Time: Avoid penalties by submitting your tax returns before the deadline.

- Save Your Receipts: Keep all relevant income and expense records for accurate filing.

- Seek Help When Needed: Don't hesitate to contact LHDN if you have questions or encounter issues.

While "semak no cukai pendapatan online" has undoubtedly made tax management more straightforward, it's essential to remember that every individual's tax situation is unique. For complex tax matters, seeking guidance from a qualified tax professional is always recommended.

In conclusion, the introduction of online tax management in Malaysia signifies a positive step towards a more efficient and user-friendly tax system. By embracing "semak no cukai pendapatan online", you're not just fulfilling your tax obligations, but also taking control of your financial well-being in a digital age.

Optum radiology jefferson valley ny your guide to advanced imaging

Experience the magic exploring the vibrant theater scene in everett wa

Unraveling the mystery william aftons wife