Securing Certainty: Navigating the Certified Check at Bank of America

In the intricate tapestry of financial transactions, there exists an air of timeless elegance, a certain je ne sais quoi, when one presents a certified check. It speaks of tradition, of assurance, of a transaction imbued with a quiet confidence. But how does one acquire such a financial instrument, particularly from an institution as renowned as Bank of America? Let's delve into the world of certified checks, unraveling the steps and nuances involved in obtaining one.

Imagine, if you will, a bustling marketplace, the air alive with the murmur of negotiations and the clinking of coins. In such a setting, a simple promise to pay might not suffice. A certified check, however, with its bank's guarantee, would be met with respect and trust. This enduring relevance speaks volumes about the enduring importance of certified checks in our modern financial landscape.

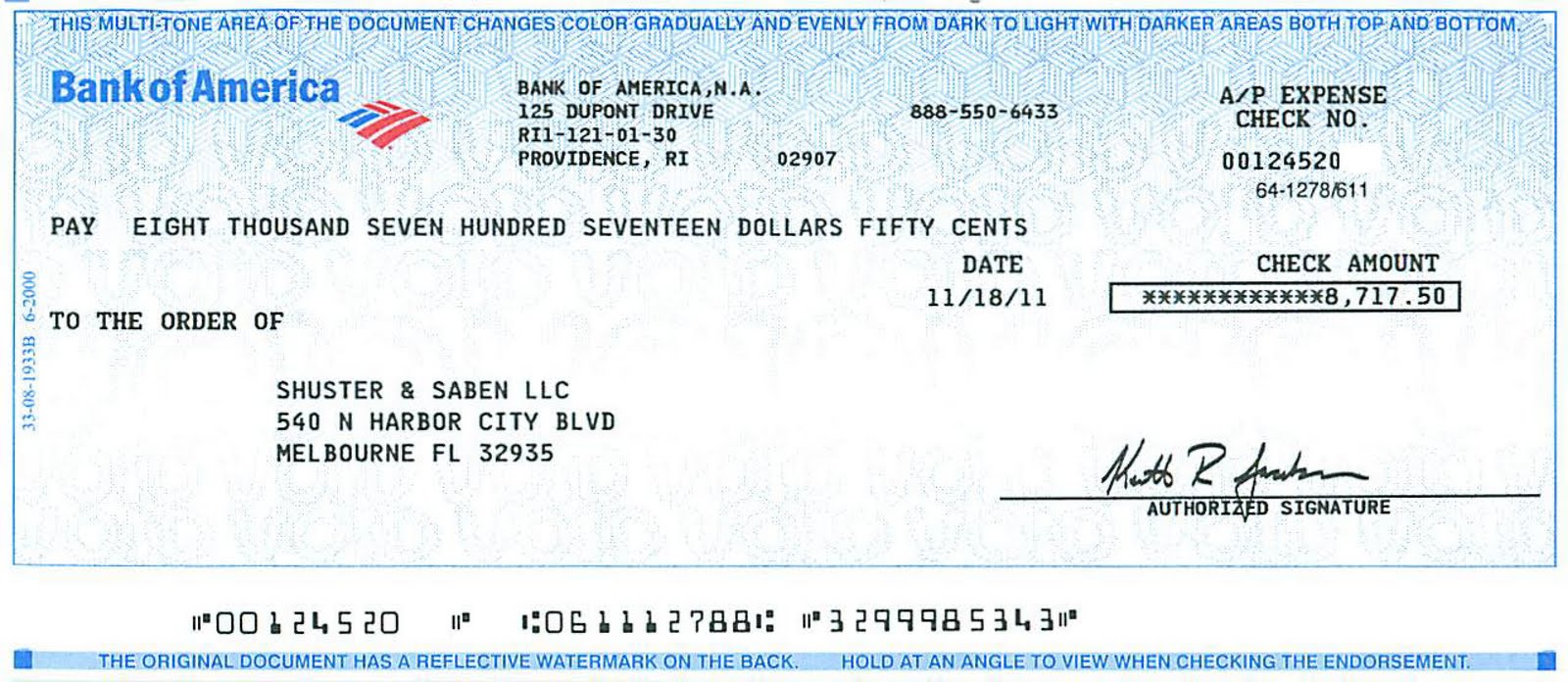

The process of obtaining a certified check from Bank of America, while rooted in tradition, is surprisingly straightforward. It begins, like any good narrative, with a visit to your local branch. The very act of stepping into the bank, with its soaring ceilings and hushed atmosphere, can feel like a scene from a classic film. You approach the teller, your request imbued with a quiet purpose. You provide your account details, the amount for the check, and the name of the payee. The teller, with practiced efficiency, verifies your information, ensuring everything is in order.

Once the details are confirmed, the funds are debited from your account, providing a tangible sense of security. The bank then issues the certified check, stamping it with their official seal, a mark of their guarantee. This process, this transfer of trust from the individual to the institution, is at the heart of what makes a certified check so valuable.

But why go through this process? Why not simply use a personal check or a wire transfer? The answer lies in the unique advantages offered by a certified check. It serves as a guarantee of funds, assuring the payee that the check will not bounce. This is particularly crucial in high-value transactions where trust is paramount, such as real estate purchases or legal settlements.

Moreover, a certified check provides a tangible record of the transaction, a physical document that can be easily tracked and verified. In an age increasingly dominated by digital transactions, this tangible element holds a certain appeal, a reassuring weight in a world of ephemeral data.

Advantages and Disadvantages of Certified Checks

| Advantages | Disadvantages |

|---|---|

| Guaranteed funds | Limited availability (must visit a branch) |

| Tangible record of transaction | Potential fees |

| Increased trust and security | Funds are held until the check is cashed |

While obtaining a certified check from Bank of America is a relatively simple process, there are certain best practices to keep in mind. Firstly, always double-check the payee's name and the amount on the check before leaving the bank. This simple step can prevent significant headaches later on. Secondly, inform the payee that you will be using a certified check, allowing them to prepare for this form of payment. Finally, keep a record of the check number and the date of issuance for your own records.

The world of finance, despite its modern complexities, still values the enduring appeal of tradition, of tangible assurance. A certified check, with its understated elegance and bank guarantee, embodies this value, providing a sense of security and trust in an increasingly digital world. So, the next time you require a payment method that exudes both confidence and tradition, consider the quiet power of a certified check from Bank of America.

Understanding uscg approved life jackets

The siren songs of the 1940s a look at the enduring legacy of female vocalists

Tumor on dogs paw causes treatments and what you need to know

:max_bytes(150000):strip_icc()/certified-check-vs-cashiers-check-which-safer-final-46f80549d89e41d9ae86fd5728692052.jpg)