Navigating the World of "Formato de Letra de Cambio Para Llenar": A Modern Guide

In a world of fast-paced transactions and evolving financial landscapes, securing and managing funds effectively is paramount. Whether you're a seasoned entrepreneur navigating international waters or an individual seeking clarity in financial agreements, having the right tools at your disposal is crucial. One such tool, steeped in history yet surprisingly relevant in our modern age, is the "letra de cambio" - a financial instrument as intriguing as its name might suggest. But fear not, for this isn't about deciphering ancient financial jargon. This is about empowering you with the knowledge to navigate the intricacies of "formato de letra de cambio para llenar" and unlock its potential in your financial endeavors.

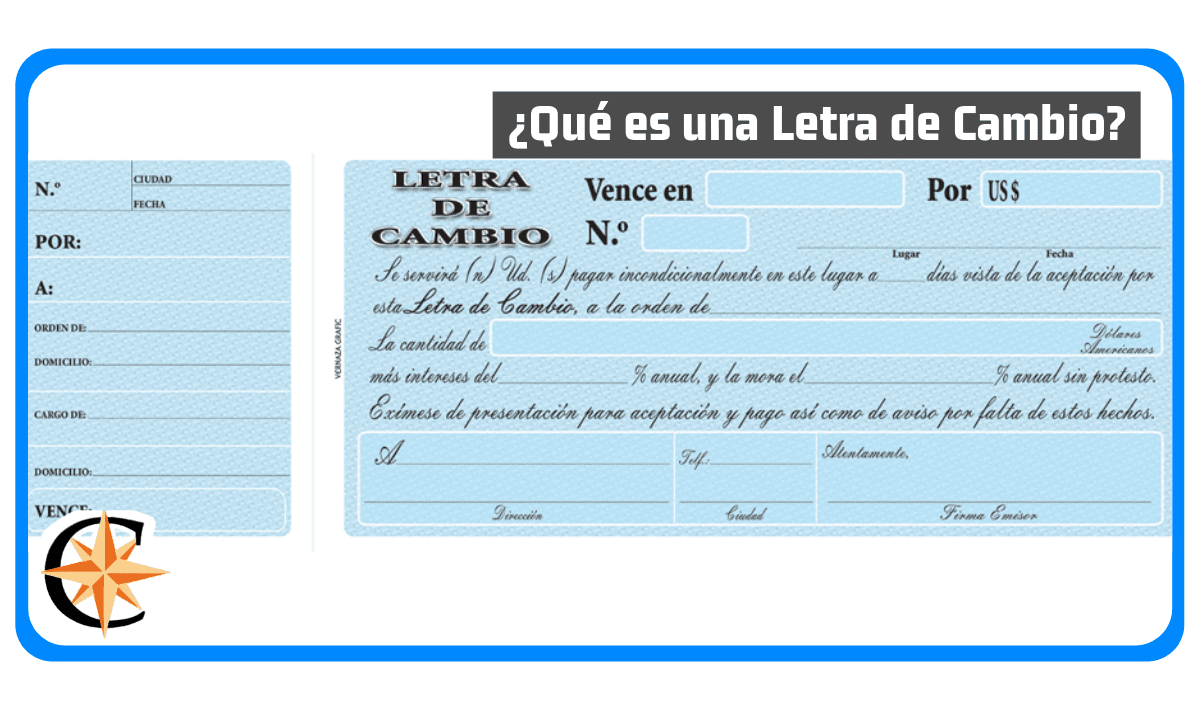

Imagine a world where agreements are more than just handshakes and promises - a world where financial commitments are clearly outlined, timelines are set in stone, and the flow of funds is as predictable as the tides. This is the world that "letra de cambio" seeks to create. At its core, it's a written, unconditional order from one party, instructing another to pay a specific amount of money on a predetermined date. Think of it as a financial dance, where each step, from the initial agreement to the final payment, is meticulously choreographed on a document known as the "formato de letra de cambio."

The beauty of "formato de letra de cambio para llenar" lies in its simplicity. It's not about navigating a labyrinth of legal jargon or deciphering complex financial models. It's about clarity, transparency, and ensuring everyone is on the same page. Picture a world where misunderstandings about payment terms are a thing of the past, where agreements are honored, and where financial transactions are smoother than a freshly brewed cup of morning coffee. That's the promise of "formato de letra de cambio para llenar" - a promise of clarity, security, and peace of mind in a world where financial well-being is paramount.

But how did this intriguing financial instrument come to be? Its roots run deep, tracing back to the bustling marketplaces of medieval Europe. In a time before credit cards and online banking, merchants and traders needed a reliable system to ensure payment for goods and services, especially across long distances. Enter the "letra de cambio," a written promise that traveled alongside goods, guaranteeing payment upon arrival. It was a revolutionary concept that fostered trust, facilitated trade, and laid the foundation for modern financial instruments.

Fast forward to today, and while the world of finance has undergone a dramatic transformation, the "letra de cambio" remains surprisingly relevant. Its enduring appeal lies in its ability to provide a sense of security and clarity in an increasingly complex financial world. While it may not be as commonplace as a credit card swipe, understanding the "formato de letra de cambio para llenar" can be incredibly empowering, especially when navigating international transactions or engaging in financial agreements that require an extra layer of security. It's like having a secret weapon in your financial arsenal, ready to be deployed when the need arises.

Cracking the code the ultimate guide to tiktok emojis

Conquering carpet conundrums a guide to carpet spot removal

Supernaturals best episode an epic quest for the ultimate fan favorite