Navigating the Labyrinth: Demystifying Bank of America Check Endorsement Policy

In today's digital age, where financial transactions happen at lightning speed, the humble check might seem like a relic of the past. Yet, it remains a surprisingly resilient payment method, particularly for large sums or situations where digital payments aren't feasible. However, navigating the world of checks, particularly when it comes to endorsements, can feel like deciphering an ancient language. This is where understanding the Bank of America check endorsement policy, or any bank's policy for that matter, becomes crucial.

Imagine receiving a check – perhaps a hard-earned paycheck or a gift from a generous relative. Before you can access those funds, you need to endorse the check, a process that involves signing the back. This simple act carries significant weight, authorizing the bank to process the check and transfer funds. But here's the catch – a poorly executed or incorrect endorsement can lead to delays, or worse, potential fraud.

This is where the Bank of America check endorsement policy comes into play, providing a roadmap for safe and efficient check processing. While the specifics of endorsement policies might differ slightly across institutions, the underlying principles remain consistent, emphasizing security and fraud prevention.

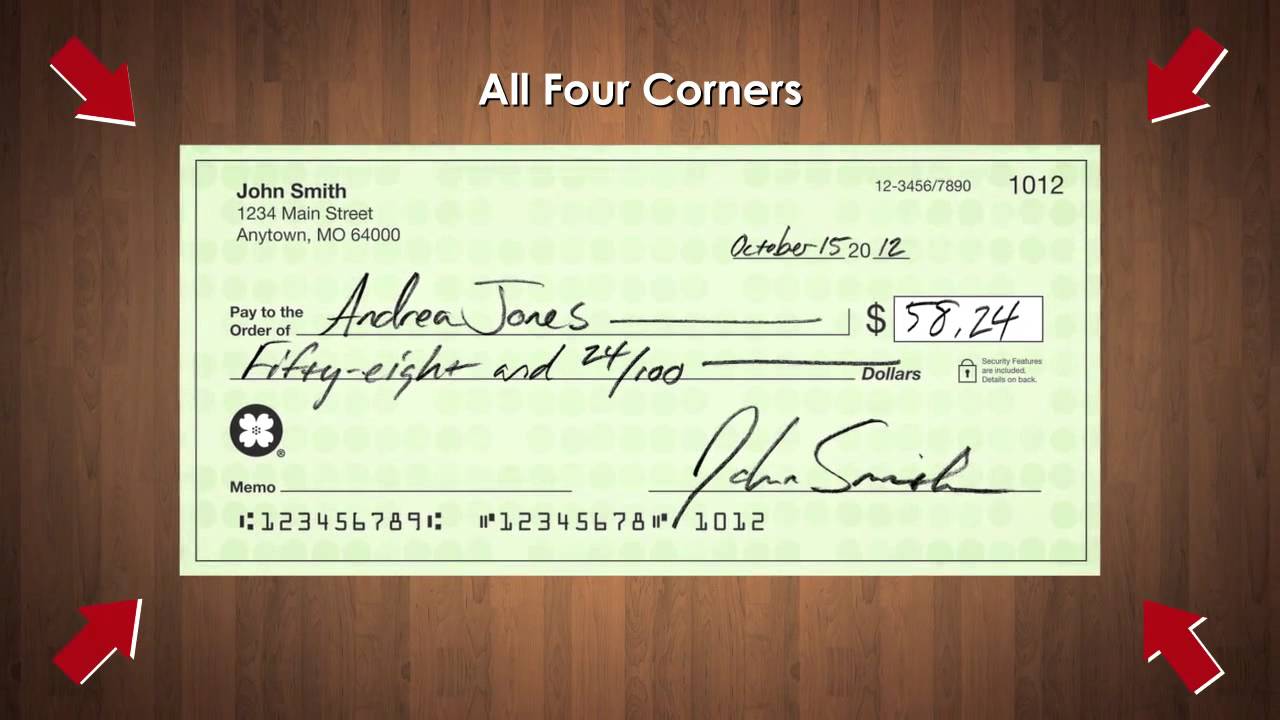

A deep dive into the nuances of the Bank of America's policy reveals a multi-layered approach to safeguarding your finances. The policy dictates the acceptable forms of endorsement, emphasizing the importance of signing your name exactly as it appears on the front of the check. It also sheds light on the use of restrictive endorsements, allowing you to add specific instructions, such as "For Deposit Only," to limit how the check can be used.

Beyond the mechanics of endorsing a check, the Bank of America check endorsement policy underscores the critical role of vigilance in our financial lives. Understanding and adhering to these guidelines empowers you to protect your funds and navigate the world of checks with confidence.

Advantages and Disadvantages of Endorsement Policies

While the specific advantages and disadvantages might vary based on individual circumstances and bank policies, here's a general overview:

| Advantages | Disadvantages |

|---|---|

| Enhanced Security | Potential for Delays |

| Fraud Prevention | Inconvenience in Certain Situations |

| Clear Guidelines for Check Processing | Limited Flexibility |

Best Practices for Check Endorsements

Here are five best practices to keep in mind when endorsing checks, regardless of the bank:

- Sign in Consistent Ink: Use the same color ink throughout the endorsement process for a professional appearance and to deter fraudulent alterations.

- Endorse in a Secure Location: Avoid endorsing checks in public or leaving them unattended to minimize the risk of theft or unauthorized access.

- Verify Check Details: Before endorsing, carefully review the check amount, payee information, and date to ensure accuracy.

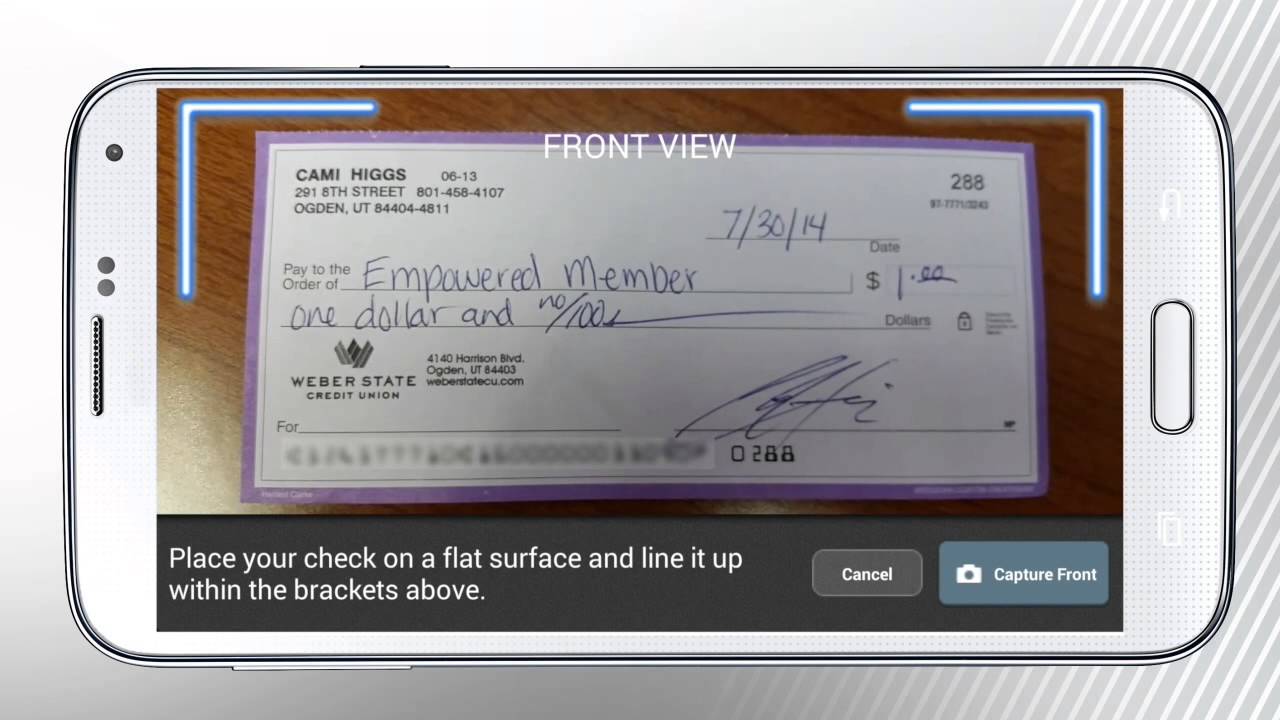

- Consider Mobile Deposit: For added convenience and security, explore mobile check deposit options offered by your bank, eliminating the need for physical endorsements in many cases.

- Consult Your Bank: If you encounter a unique situation or have specific questions regarding check endorsements, don't hesitate to reach out to your bank's customer service for guidance.

Common Questions and Answers

1. What happens if I misspell my name on the endorsement?

It's best to contact your bank for guidance, as they might require a corrected endorsement or provide alternative solutions.

2. Can I endorse a check over to someone else?

Yes, but it involves additional steps and might vary depending on the bank. Generally, you'll need to use a special endorsement, such as "Pay to the order of [Name]."

3. How long does it take for a check to clear after endorsement?

Check clearing times vary but are typically within a few business days. Mobile deposits often have faster processing times.

4. What should I do if I lose a check I've already endorsed?

Contact your bank immediately to report the lost check and inquire about stop payment options.

5. Are there different endorsement requirements for business checks?

Yes, business check endorsements might have additional requirements or authorization procedures. Consult your bank for specific guidelines.

6. Can I endorse a check with a stamp instead of a signature?

Generally, banks prefer handwritten signatures for endorsements. However, exceptions might exist for businesses using authorized deposit stamps. Check with your bank to confirm their policy.

7. What is a restrictive endorsement and when should I use it?

A restrictive endorsement adds specific instructions to the check, limiting how it can be used. For example, "For Deposit Only" restricts the check to being deposited into your account, enhancing security.

8. Where can I find more information about Bank of America's specific endorsement policy?

You can typically find detailed information on the bank's website, in their terms and conditions, or by contacting customer service.

Conclusion

In the intricate dance of financial transactions, understanding your bank's check endorsement policy emerges as a fundamental step. Bank of America's policy, much like those of other institutions, serves as a safeguard, protecting your funds and ensuring the smooth processing of your checks. While the digital age ushers in new payment methods, checks remain relevant, and their proper handling, particularly endorsements, is crucial. By familiarizing yourself with the nuances of endorsement policies, adopting best practices, and staying vigilant, you can confidently navigate the world of checks, knowing that your finances are secure.

The subtle art of car stereo wiring upgrading your automotive soundscape

Connecting the world the rise of online chat for spanish speakers

Unleash silverados towing power your guide to the chevy silverado tow package

/back-of-check-endorsed2-57a350e95f9b589aa907ed7e.jpg)