Navigating PTPTN Loan Repayment Exemptions: Rayuan Pengecualian Bayaran Balik PTPTN

The weight of student loans can be a heavy burden to bear, especially in a challenging economic climate. In Malaysia, the National Higher Education Fund Corporation (PTPTN) has been instrumental in providing financial assistance to countless students pursuing higher education. However, the obligation to repay these loans can be daunting for some graduates. This is where understanding the nuances of PTPTN loan repayment exemptions, often referred to as "rayuan pengecualian bayaran balik PTPTN," becomes crucial.

Navigating the complexities of loan repayment exemptions requires a firm grasp of the eligibility criteria, the application procedure, and the potential benefits. This article aims to demystify the process, providing readers with a comprehensive understanding of this crucial aspect of PTPTN loans. Whether you're a recent graduate grappling with loan repayment or simply seeking information on this topic, this guide will equip you with the knowledge you need.

The concept of "rayuan pengecualian bayaran balik PTPTN" revolves around the idea of providing financial relief to deserving individuals who might face difficulties in fulfilling their loan repayment obligations. It acknowledges that circumstances can change drastically from the time a loan is taken to the point of repayment, and aims to offer a safety net for those who qualify. This system is a testament to the PTPTN's commitment to not just providing access to education, but also to ensuring that the repayment process is manageable and equitable.

Delving into the intricacies of the exemption process, it's important to understand that not everyone automatically qualifies for a full or partial exemption. There are specific criteria that applicants need to meet, and these criteria can vary depending on the type of exemption being sought. For instance, individuals seeking full exemption might need to demonstrate exceptional academic achievements, while those applying for partial exemptions might need to provide proof of financial hardship.

The importance of "rayuan pengecualian bayaran balik PTPTN" cannot be overstated. For many graduates facing financial constraints, this exemption can be the difference between starting their careers burdened by debt or having the financial breathing room to pursue their aspirations. It can also alleviate the stress and anxiety associated with loan repayment, allowing graduates to focus on building their futures.

Advantages and Disadvantages of PTPTN Loan Repayment Exemptions

While PTPTN loan repayment exemptions offer a lifeline to many, it is essential to weigh the pros and cons before applying:

| Advantages | Disadvantages |

|---|---|

| Financial Relief: Reduces or eliminates the burden of monthly repayments. | Eligibility Criteria: Strict requirements may disqualify some applicants. |

| Opportunity to Excel: Allows graduates to focus on career growth and personal development without financial constraints. | Limited Time Frame: Applications are often time-sensitive, requiring careful planning. |

Understanding these advantages and disadvantages can help potential applicants make informed decisions about pursuing loan repayment exemptions.

Five Best Practices for PTPTN Loan Repayment Exemptions

Navigating the PTPTN loan repayment exemption process can be complex. These five best practices can increase your chances of a successful application:

- Early Research and Planning: Begin researching exemption options well in advance of your repayment commencement date. Understand the eligibility criteria and gather necessary documentation early.

- Thorough Documentation: Submit all required documents, ensuring they are clear, accurate, and up-to-date. Incomplete or inaccurate information can lead to delays or rejections.

- Timely Submission: Adhere to application deadlines strictly. Late submissions are often automatically disqualified.

- Open Communication: Maintain open communication with PTPTN throughout the process. Respond promptly to inquiries and seek clarification on any unclear instructions.

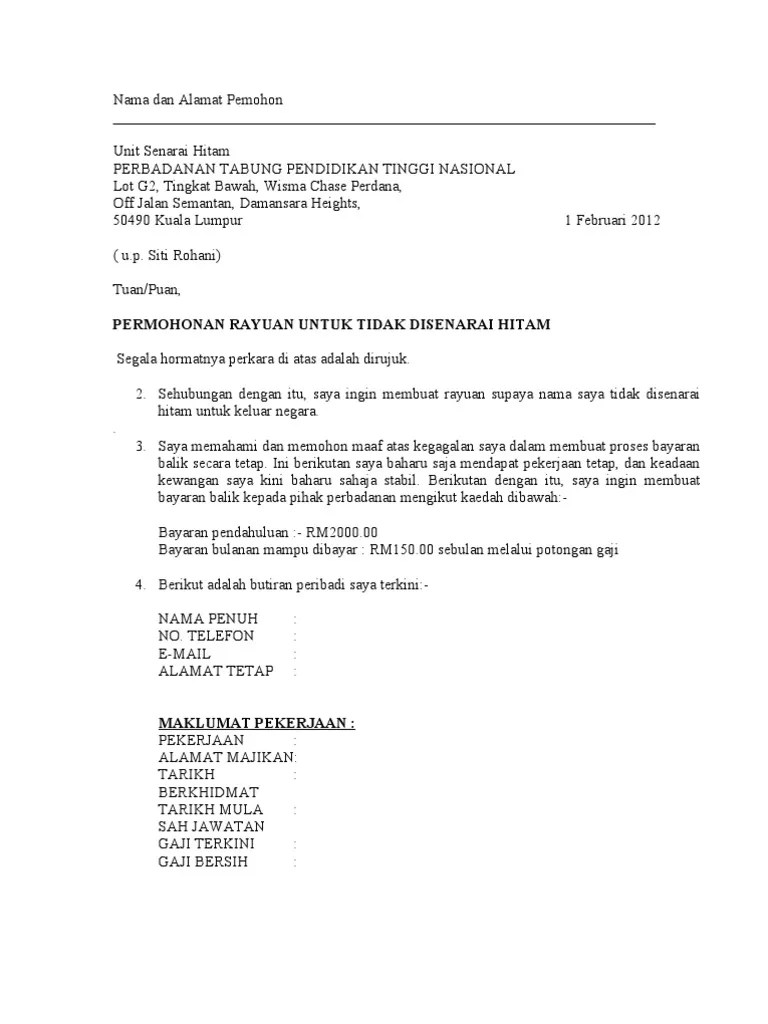

- Appeal if Necessary: If your initial application is rejected, don't hesitate to file an appeal if you believe you meet the eligibility criteria. Provide additional supporting documents and a strong justification for your appeal.

Common Questions and Answers about PTPTN Loan Repayment Exemptions

Here are some of the most frequently asked questions about PTPTN loan repayment exemptions:

- Q: Who is eligible for PTPTN loan repayment exemptions?

- Q: What documents do I need to apply for an exemption?

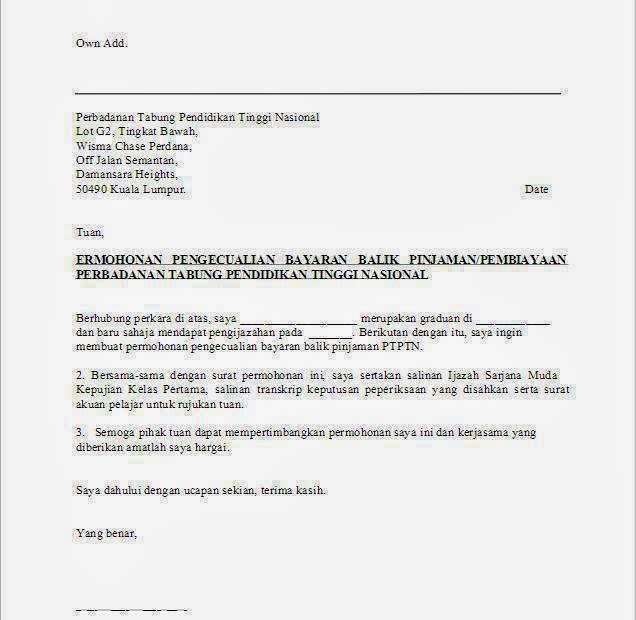

- Q: How do I apply for a PTPTN loan repayment exemption?

- Q: What happens if my exemption application is rejected?

- Q: Can I apply for an exemption after I have started repaying my loan?

- Q: Are there any penalties for unsuccessful exemption applications?

- Q: How long does it take to process an exemption application?

- Q: Where can I find more information about PTPTN loan repayment exemptions?

A: Eligibility criteria vary depending on the type of exemption. Common grounds include exceptional academic performance, disability, or severe financial hardship.

A: Required documents typically include academic transcripts, identification documents, proof of income (if applicable), and supporting documents related to the specific exemption category.

A: Applications are typically submitted online through the official PTPTN website. Detailed instructions and forms are available on the website.

A: You can appeal the decision with proper justification and supporting documents within a specific timeframe.

A: Yes, you can apply for an exemption even after you have commenced repayment, provided you meet the eligibility criteria.

A: No, there are typically no penalties for unsuccessful applications. However, you will need to resume your regular loan repayments.

A: Processing times vary but typically range from a few weeks to a few months.

A: The official PTPTN website is the most reliable source of information. You can also contact their customer service for further assistance.

Tips and Tricks for a Successful PTPTN Loan Repayment Exemption Application

While meeting the eligibility criteria is crucial, these additional tips can improve your chances of a successful application:

- Present a Compelling Case: Clearly articulate your reasons for seeking an exemption in your application. Back up your claims with strong supporting documents.

- Highlight Achievements: If applying based on academic excellence, highlight your accomplishments prominently.

- Detail Financial Hardship: If claiming financial hardship, provide detailed and accurate financial records. Transparency is key.

- Seek Professional Assistance: Consider consulting with financial advisors or education consultants for personalized guidance.

- Stay Updated: Regularly check the PTPTN website for any changes in policies or procedures.

Understanding and navigating the "rayuan pengecualian bayaran balik PTPTN" process is crucial for any Malaysian graduate seeking financial relief from their PTPTN loans. This comprehensive guide has provided insights into the intricacies of these exemptions, equipping readers with the knowledge to approach the process confidently. Remember, meticulous planning, thorough documentation, and timely action are key to a successful application. PTPTN loan repayment exemptions are not merely a financial reprieve; they represent an investment in the future of Malaysia's brightest minds. By easing the burden of debt, these exemptions pave the way for graduates to contribute meaningfully to society without being shackled by financial constraints.

Unmasking the drama el zorro la espada y la rosa capitulo 14

Unveiling the mystery como se creo la letra f

Unpacking rizals sa aking mga kabata a guide for the youth