Navigating JPMorgan Chase Wire Transfers: A Comprehensive Guide

Transferring funds quickly and securely is crucial in today’s interconnected world. Wire transfers provide a reliable method for moving large sums of money domestically and internationally. If you’re considering a wire transfer with JPMorgan Chase, understanding the necessary information, including the correct wiring instructions and address, is paramount. This guide will walk you through the essentials of JPMorgan Chase wire transfers, providing a comprehensive understanding of the process.

Initiating a wire transfer with JPMorgan Chase requires specific details, including the bank's routing number, your account number, the recipient's bank details, and the correct JPMorgan Chase receiving address for wire transfers. Locating this information accurately is the first step to a successful transfer. This guide aims to clarify how to obtain these critical details and navigate the process efficiently.

JPMorgan Chase, a leading global financial institution, offers a robust platform for wire transfers. The bank's extensive network and advanced security measures make it a popular choice for businesses and individuals alike. However, the process can seem complex for first-time users. Understanding the bank's specific requirements and procedures for wire transfers is essential to avoid delays and potential errors.

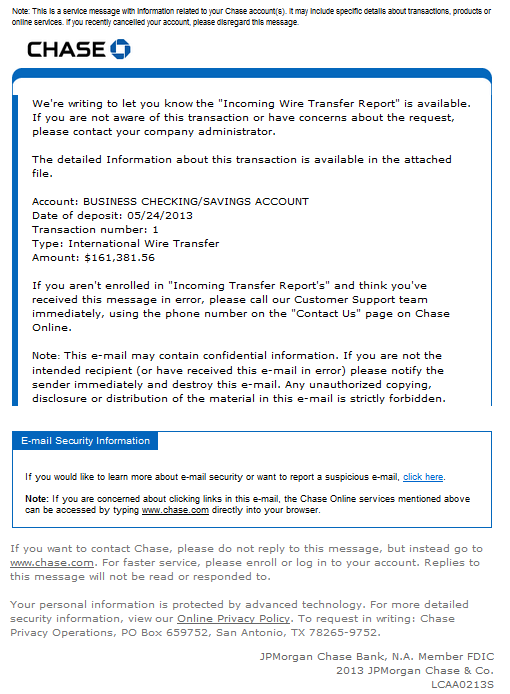

Accurate JPMorgan Chase wire instructions and addresses are fundamental to the successful execution of your transfer. Errors in these details can lead to delays, returned funds, or even the loss of money. Therefore, double-checking all information before submitting your wire transfer request is critical. This article will provide guidance on verifying these details to ensure a smooth and secure transaction.

This guide will cover various aspects of JPMorgan Chase wire transfers, from finding the correct receiving address to understanding the associated fees and timelines. We'll delve into security best practices, common challenges, and troubleshooting tips, providing you with a complete resource for navigating the JPMorgan Chase wire transfer process.

The history of wire transfers goes back to the telegraph era. JPMorgan Chase, with its rich history in finance, has been a key player in the evolution of this technology. The importance of accurate routing instructions and addresses has only increased with the globalization of finance and the rise of digital banking.

A JPMorgan Chase wire transfer address isn't a physical location where you send money. It's a combination of specific codes and identifiers that direct the transfer to the correct account within the bank's system. These codes include the bank's routing number, SWIFT code for international transfers, and your unique account number.

One benefit of using wire transfers is speed. They are generally faster than ACH transfers. Another benefit is security. Wire transfers offer robust security measures. Lastly, they are reliable for large sums of money.

Before initiating a wire transfer, gather the recipient's full name, bank name and address, account number, SWIFT code (for international transfers), and the amount to be transferred. Double-check all details for accuracy. Contact JPMorgan Chase customer support to confirm the correct receiving address for wire transfers.

Common challenges with wire transfers include incorrect recipient information, delays due to intermediary banks, and security concerns. Solutions involve double-checking information, using trusted banking platforms, and implementing strong security measures.

Frequently Asked Questions:

What is a wire transfer?

How long does a JPMorgan Chase wire transfer take?

What are the fees associated with wire transfers?

How do I track my wire transfer?

What should I do if my wire transfer is delayed?

How can I cancel a wire transfer?

Is it safe to send money via wire transfer?

Where can I find the JPMorgan Chase wire transfer instructions?Tips and tricks for a smooth wire transfer experience: always double-check recipient information, initiate transfers during business hours for faster processing, keep records of your transaction details, and use JPMorgan Chase's online platform for convenient tracking.

In conclusion, understanding JPMorgan Chase wire transfer instructions and address is crucial for successful and secure transactions. By following the guidelines outlined in this guide, you can navigate the process with confidence, minimizing the risk of errors and ensuring your funds reach their destination efficiently. From gathering the necessary information to verifying the recipient's details and utilizing best security practices, taking proactive steps is essential for a smooth and secure wire transfer experience. By being informed and prepared, you can harness the power of wire transfers to manage your finances effectively in today's fast-paced global economy. Remember to always double-check information, utilize secure platforms, and contact customer support for any questions. This will empower you to navigate the complexities of wire transfers and achieve your financial goals efficiently and securely. Taking the time to understand these details can save you time, money, and potential frustration in the long run. Therefore, prior to initiating any wire transfer, familiarize yourself with JPMorgan Chase's specific procedures and always prioritize security.

Midsegment of a triangle questions

The edgy charm of badtz maru a sanrio icons digital journey

Jet woodworking tools suppliers list your workshops best friend