Navigating Indonesian Taxes: Understanding the NPWP Card

So, you're dealing with Indonesian taxes? Whether you're a local or an expat working or investing in Indonesia, the NPWP (Nomor Pokok Wajib Pajak) is a crucial document. It's essentially your Indonesian Taxpayer Identification Number, and having one simplifies a lot of financial processes. It's like a social security number for taxes – without it, you're navigating a complex system without a key piece of the puzzle.

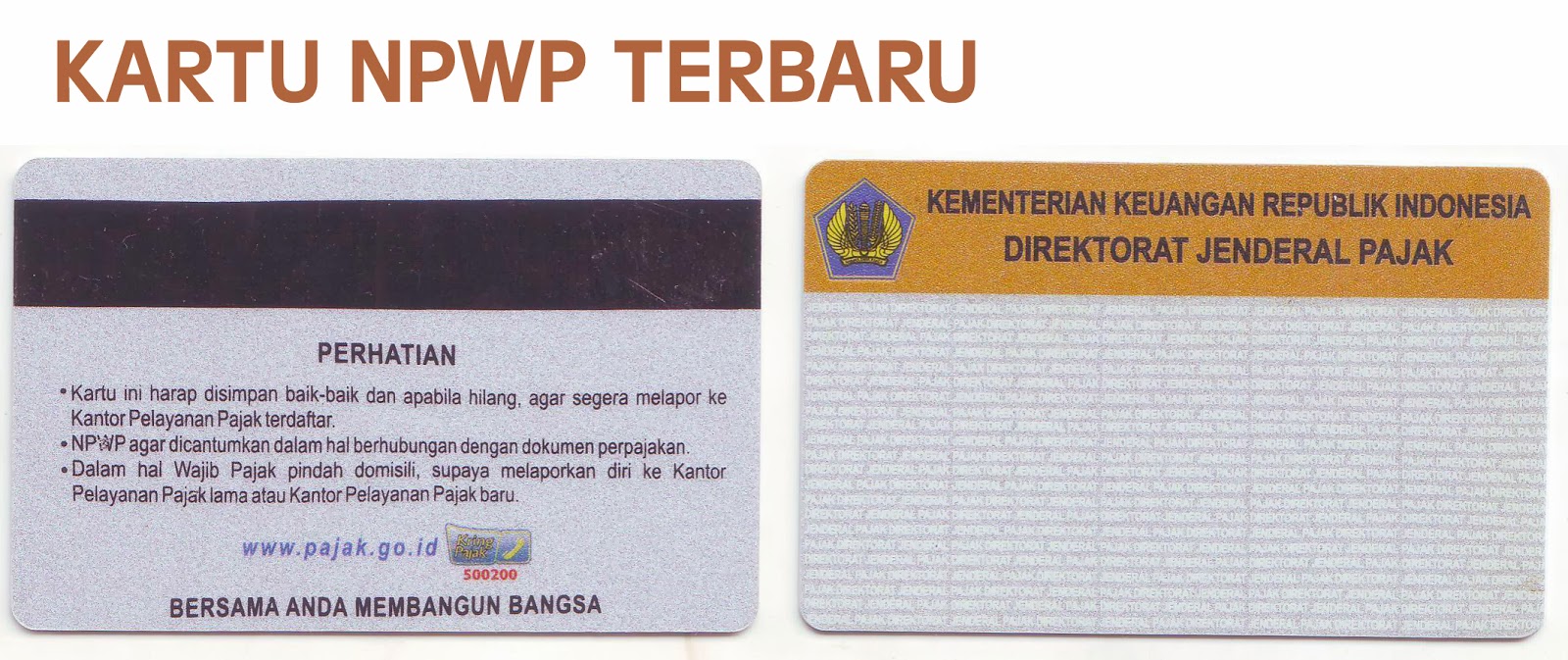

Many people search for a "download kartu npwp kosong pdf," hoping to find a blank NPWP card template. However, downloading a blank NPWP card and filling it out yourself isn't the correct procedure. The NPWP card is officially issued by the Indonesian Directorate General of Taxes (DGT) after you've successfully registered and your application is approved. Thinking about getting an NPWP in Indonesia can be daunting, especially if you're unfamiliar with the process. This article will break down everything you need to know about the NPWP, from its importance to navigating the application process.

The NPWP system has evolved over time, reflecting Indonesia's developing tax regulations. Initially, the process was largely paper-based, but now, online registration is available, making it more accessible. The NPWP is essential for various financial activities, including opening a bank account, conducting business transactions, purchasing property, and applying for certain permits or licenses. Without an NPWP, you might face higher tax rates and difficulties in accessing certain financial services.

Obtaining an NPWP provides numerous benefits. Firstly, it simplifies tax compliance. With an NPWP, you can file your taxes correctly and avoid penalties. Secondly, it enables you to access various financial services that require an NPWP, such as applying for loans or opening investment accounts. Thirdly, having an NPWP demonstrates your commitment to complying with Indonesian tax regulations, which can be beneficial for business dealings and building trust with Indonesian counterparts.

While the "download kartu npwp kosong pdf" search is common, focusing on the official application process is crucial. The DGT provides comprehensive information and resources on their website, guiding you through the registration steps. Instead of searching for blank templates, access the official DGT website to initiate the application process. Understanding the proper channels for obtaining your NPWP card is essential for ensuring a smooth and legitimate registration experience.

The NPWP was established to streamline tax administration and improve tax compliance in Indonesia. It plays a vital role in the country's revenue collection system and helps fund public services.

The NPWP is a unique 15-digit number assigned to every taxpayer in Indonesia. It's used to track tax payments and ensure compliance with tax regulations.

A key issue related to the "download kartu npwp kosong pdf" search is the potential for misuse or misunderstanding of the NPWP system. It's crucial to rely on official sources and procedures for obtaining your NPWP.

Instead of searching for a "download kartu npwp kosong pdf", visit the official DGT website. You can apply online or visit a tax office.

Advantages and Disadvantages of Having an NPWP

| Advantages | Disadvantages |

|---|---|

| Easier tax compliance | Administrative burden of applying and maintaining records |

| Access to financial services | Potential for misuse of NPWP information if not handled securely |

Best Practices for NPWP Registration: Use the official DGT website, prepare required documents, double-check information for accuracy, keep your NPWP information secure, and consult a tax professional if needed.

Frequently Asked Questions: What is an NPWP? How do I apply for an NPWP? What documents are required? What if I lose my NPWP card? Where can I find more information about the NPWP? What are the penalties for not having an NPWP? Can foreigners apply for an NPWP? What is the difference between an individual and a company NPWP?

In conclusion, understanding the NPWP system is crucial for anyone involved in financial activities in Indonesia. While the "download kartu npwp kosong pdf" search might seem like a shortcut, following the official registration process through the DGT is the correct and most efficient approach. Obtaining an NPWP offers numerous benefits, from streamlined tax compliance to access to essential financial services. By understanding the importance of the NPWP and navigating the system correctly, you can ensure smooth financial operations and contribute to Indonesia's tax system. Start by visiting the official DGT website for accurate information and guidance on obtaining your NPWP. Don't hesitate to seek professional advice if you encounter any challenges during the application process. A solid understanding of the NPWP system empowers you to participate fully in Indonesia's financial landscape.

Sunset hills cemetery obituaries

Taming the tide a deep dive into boat washdown pumps

Unlocking leathercraft mastering patterns and templates