Mastering Indonesian Income Tax Calculation: A Comprehensive Guide

Navigating the world of taxes can feel like traversing a complex maze, especially in a foreign country. In Indonesia, understanding the intricacies of "cara penghitungan pajak penghasilan," or income tax calculation methods, is crucial for both individuals and businesses. This guide will demystify the process, providing you with the knowledge and tools to approach your tax obligations with confidence.

Before diving into the specifics, it's important to grasp the underlying principles of Indonesia's income tax system. This system operates on a "self-assessment" basis, meaning that taxpayers are responsible for calculating their own tax liability and filing accurate returns. The tax year in Indonesia follows the calendar year, from January 1st to December 31st.

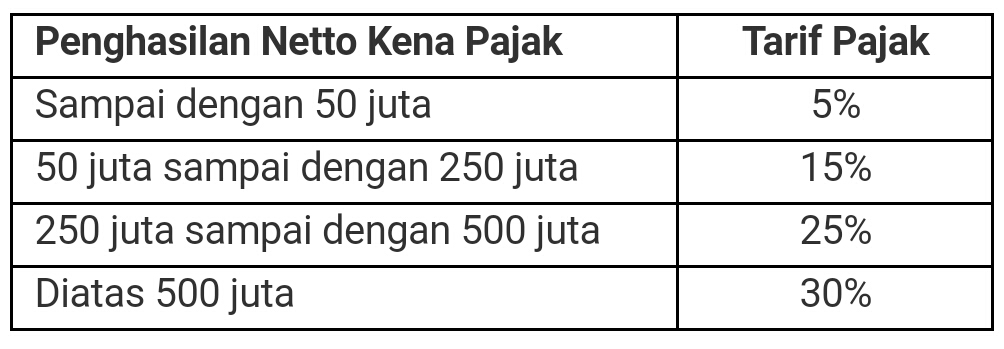

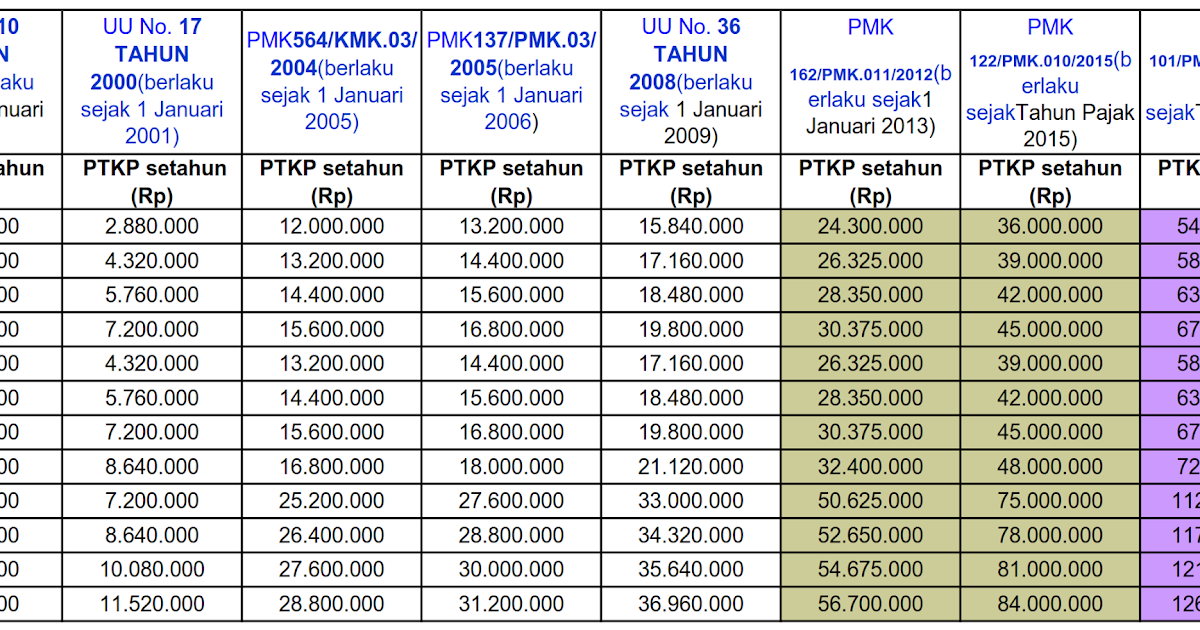

Indonesia utilizes a progressive tax rate system, meaning the percentage of tax you pay increases as your taxable income rises. This ensures a fairer distribution of the tax burden, with higher earners contributing a larger proportion of their income. Familiarity with these fundamental concepts forms the bedrock of effective income tax calculation in Indonesia.

Accurate and timely tax calculation is not just a legal obligation but also a smart financial practice. By understanding the nuances of deductions, exemptions, and tax credits available, you can potentially reduce your tax liability and optimize your financial resources. Moreover, staying informed about changes in tax laws and regulations is paramount to ensure compliance and avoid penalties.

This guide will equip you with the knowledge to navigate the intricacies of Indonesian income tax calculation, allowing you to meet your tax obligations effectively and make informed financial decisions.

Advantages and Disadvantages of Indonesia's Income Tax System

Let's delve into the pros and cons of Indonesia's income tax system:

| Advantages | Disadvantages |

|---|---|

| Progressive tax rates promote fairness. | Tax regulations can be complex and subject to change. |

| Various deductions and exemptions are available to reduce tax liability. | Self-assessment system relies on individual understanding and compliance. |

| Tax revenue funds essential public services and infrastructure. | Penalties for non-compliance can be significant. |

Best Practices for Managing Your Indonesian Income Tax

To simplify your income tax journey in Indonesia, consider these best practices:

- Maintain meticulous financial records: Keep thorough records of all income, expenses, and relevant documentation. This organized approach streamlines the tax calculation process and supports the accuracy of your tax returns.

- Familiarize yourself with tax laws: Stay updated on changes in tax regulations, deductions, and exemptions. The Indonesian tax authority's official website is an excellent resource for current information.

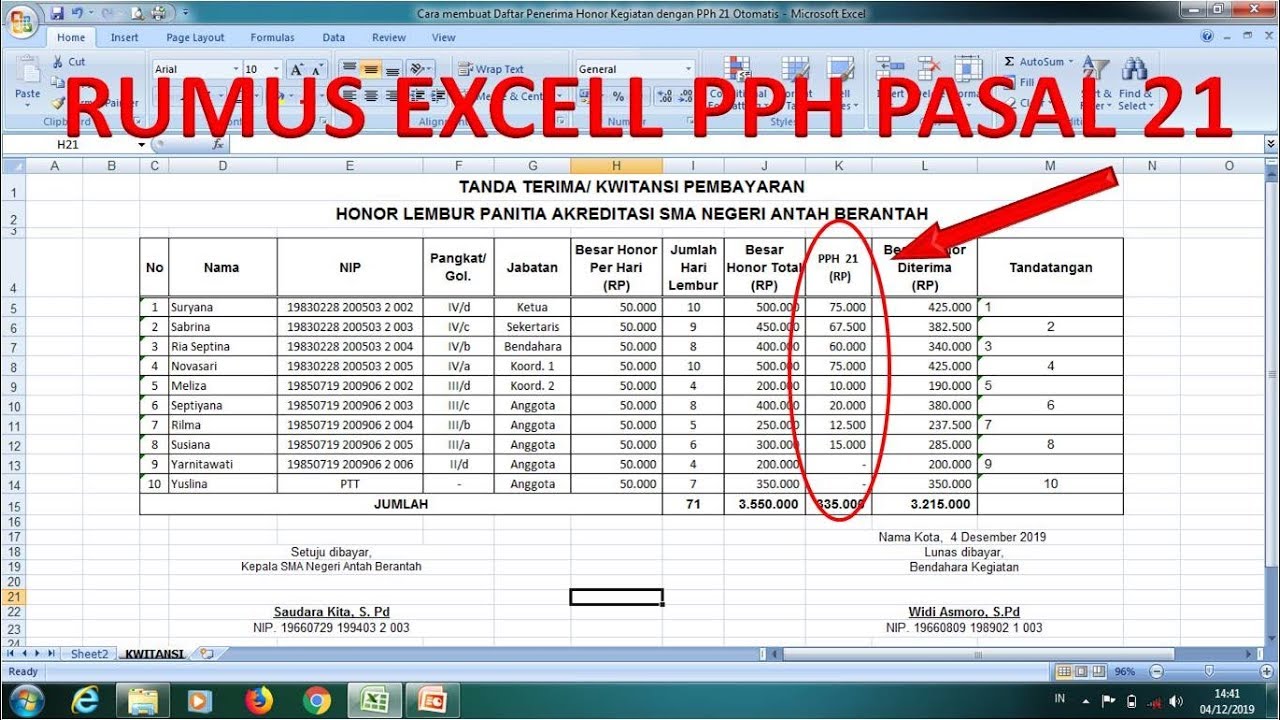

- Leverage technology: Explore tax software or online calculators specifically designed for the Indonesian tax system. These tools can automate calculations, minimize errors, and simplify the filing process.

- Seek professional guidance: If you encounter complexities or have specific tax-related questions, consult with a qualified tax advisor or accountant in Indonesia. Their expertise can prove invaluable in optimizing your tax position.

- File on time: Adhere to tax deadlines to avoid penalties. The Indonesian tax authority typically sets clear deadlines for tax filing and payments.

By embracing these best practices and maintaining a proactive approach to understanding and fulfilling your Indonesian income tax obligations, you can navigate the process with greater ease and confidence.

Remember, this guide provides general information and should not be considered professional financial or tax advice. Always consult with qualified professionals for personalized guidance tailored to your specific circumstances.

Slay the gram your guide to killer instagram usernames for baddies

The cultivated canvas embracing the summer vegetable garden

Unlocking extra space exploring hip roof home plans with bonus room