LLC Operating Agreements: A Comprehensive Guide

Starting a business is an exciting venture, and choosing the right structure is crucial for its success. Many entrepreneurs opt for the Limited Liability Company (LLC) structure because of its flexibility and liability protection. But what truly solidifies the foundation of an LLC? It's the LLC operating agreement, a document often overlooked but incredibly important. What exactly is this document, and why is it so vital for your business's well-being?

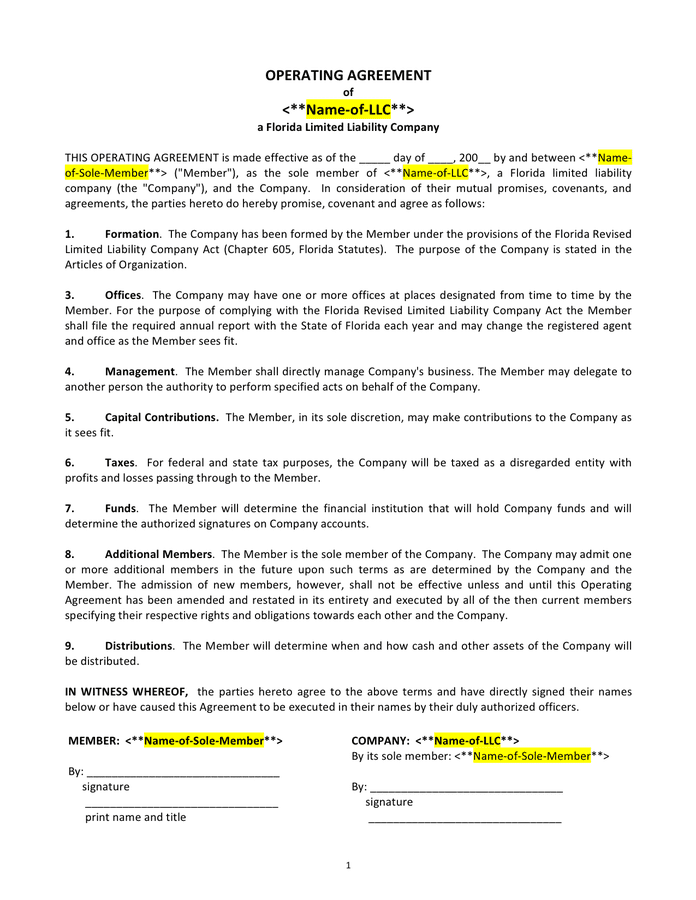

An LLC operating agreement, sometimes referred to as an LLC member agreement, is a legally binding contract that outlines the ownership structure, member responsibilities, and operating procedures of an LLC. Think of it as a blueprint for how your business will be run. While not always legally required by every state, having a well-drafted operating agreement is highly recommended. It provides clarity, prevents misunderstandings, and can protect your limited liability status.

Historically, the concept of limited liability emerged to encourage entrepreneurship by separating personal assets from business debts. The LLC structure itself is a relatively modern development, becoming increasingly popular in recent decades. The operating agreement serves as a crucial component of this structure, formalizing the internal workings of the LLC and adding a layer of legal protection.

One of the key issues surrounding LLC operating agreements is the misconception that they are unnecessary, especially for single-member LLCs. This is a dangerous assumption. Even with a single owner, a formalized agreement demonstrates a clear separation between personal and business affairs, which can be crucial in maintaining the limited liability protection that the LLC structure offers. Without a documented agreement, state default rules will govern the LLC, which may not align with your specific business needs.

A well-defined operating agreement outlines several key aspects of the LLC. These include the percentage of ownership each member holds, allocation of profits and losses, member responsibilities and duties, voting rights, procedures for admitting new members or withdrawing existing members, and provisions for dissolving the LLC. A comprehensive LLC agreement example can serve as a valuable template for drafting your own, but it's always recommended to seek legal counsel to ensure it meets the specific needs and legal requirements of your state.

One benefit of having an operating agreement is that it clarifies ownership and responsibilities. For example, if two members contribute different amounts of capital, the agreement clearly states each member's ownership percentage. Another benefit is that it helps prevent disputes. By outlining decision-making processes and dispute resolution mechanisms, the agreement minimizes the potential for conflict. Finally, it strengthens the limited liability protection of the LLC. A well-drafted agreement can help demonstrate to the courts that the LLC is a separate legal entity from its members, protecting personal assets from business liabilities.

To create an effective LLC operating agreement, first, gather information about all members, including their contributions and roles. Second, research your state's specific requirements for LLC agreements. Third, consult with an attorney to ensure the agreement is legally sound and tailored to your business needs.

Advantages and Disadvantages of an LLC Operating Agreement

| Advantages | Disadvantages |

|---|---|

| Clarifies ownership and responsibilities | Requires time and effort to create |

| Helps prevent disputes | Can be complex for intricate businesses |

| Strengthens limited liability protection | May require legal assistance, incurring costs |

Best Practices: 1. Tailor the agreement to your specific business. 2. Clearly define member roles and responsibilities. 3. Include a dispute resolution mechanism. 4. Review and update the agreement regularly. 5. Consult with legal counsel.

Frequently Asked Questions: 1. Is an operating agreement required? 2. What should be included in an operating agreement? 3. Can I modify the agreement later? 4. What happens if we don’t have an operating agreement? 5. Who should draft the operating agreement? 6. Where should I keep the operating agreement? 7. Do I need a lawyer to create an operating agreement? 8. Can I use a template operating agreement?

Tips and Tricks: Consider using an online template as a starting point. Be sure to adapt the template to your specific needs. Keep the language clear and concise. Store the agreement securely.

In conclusion, an LLC operating agreement is a foundational document for any limited liability company. While it might seem like an extra step in the already complex process of starting a business, its benefits far outweigh the effort involved. By clearly outlining ownership, responsibilities, and operating procedures, the agreement protects the interests of the members, helps prevent disputes, and strengthens the limited liability protection the LLC offers. Taking the time to create a comprehensive and legally sound operating agreement is an investment in the long-term health and success of your business. Don't leave your business's future to chance; secure it with a well-drafted operating agreement today. Consult with a legal professional to ensure you have the best possible agreement for your specific situation. They can guide you through the process, answer your questions, and tailor the agreement to meet your unique needs. Taking this proactive step can save you time, money, and potential headaches down the road.

Heartfelt birthday wishes for your special daughter frases de cumpleanos para una hija especial

Conquering the road unleashing the power of the chevy silverado with max tow package

Decoding sherwin williams base white the ultimate guide