Life's Curveballs: When Qualifying Life Event Insurance Is Your Safety Net

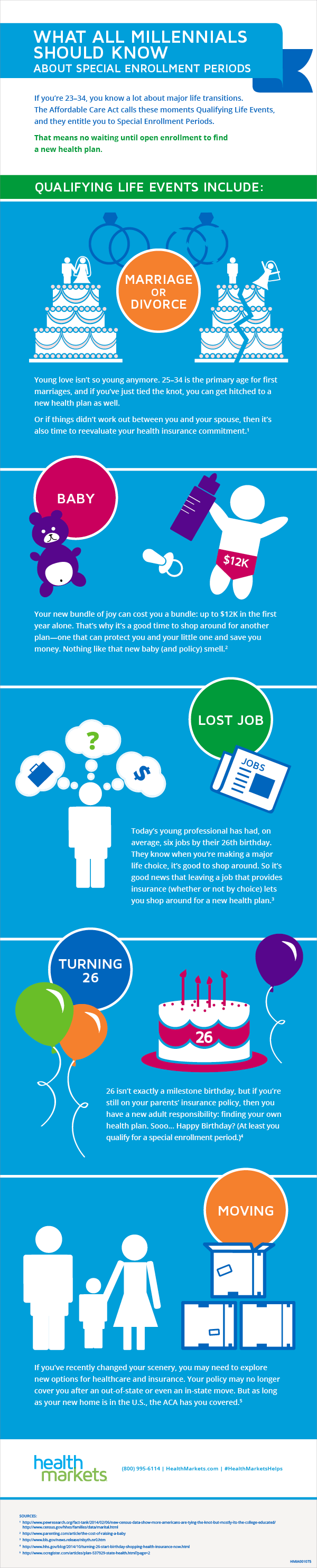

Life is a wild ride. It throws unexpected curveballs – some exhilarating, like landing your dream job or welcoming a new family member, and some, well, not so much. Think sudden job loss or a health scare. These major life moments aren't just emotionally charged; they often come with financial implications that can leave you scrambling. That's where "qualifying life events" and their connection to your insurance come into play. Ever wondered why there are specific times you can tweak your health insurance plan, even when it's not open enrollment season? Those, my friend, are the moments we're talking about.

Imagine this: you just got married (congrats!), and you're realizing that your individual health insurance plan might not cut it for a growing family. Or maybe you've landed that amazing new job, but it doesn't offer the same level of life insurance coverage as your previous employer. These are prime examples of qualifying life events. They're significant changes in your life that trigger a special enrollment period, allowing you to adjust your insurance coverage to match your new reality.

We're talking about events like marriage, divorce, having a baby, adopting a child, losing health coverage, moving to a new area, and sadly, even the death of a spouse. These moments are recognized by insurance companies and government programs like Medicare and Medicaid as significant enough to warrant potential adjustments to your coverage.

Why is this whole "qualifying life event" thing important? Well, imagine being stuck with an inadequate health insurance plan when you suddenly have a family to consider. Or worse, imagine if something happened to you, and your loved ones were left financially vulnerable because you couldn't update your life insurance after a major life change. Not ideal, right?

Understanding qualifying life events is about taking control of your insurance destiny. It's about ensuring you have the right coverage when you need it most, allowing you to navigate life's ups and downs with a little more peace of mind. So, buckle up, because we're diving deep into the world of qualifying life event insurance, exploring everything from the specific events that qualify to how to make the most of these crucial windows of opportunity.

Advantages and Disadvantages of Qualifying Life Event Insurance

| Advantages | Disadvantages |

|---|---|

| Opportunity to adjust coverage outside of open enrollment. | Limited time frame to make changes. |

| Provides flexibility to adapt to major life changes. | Requires documentation to prove the qualifying event. |

| Can ensure you have adequate coverage when you need it most. | May not always result in lower premiums. |

Best Practices for Navigating Qualifying Life Events and Insurance

1. Know Your Triggers: Familiarize yourself with the common qualifying life events. Understanding what qualifies can help you anticipate when you might need to re-evaluate your coverage.

2. Act Quickly: Time is of the essence. Once a qualifying event occurs, you usually have a limited window (often 30 or 60 days) to make changes to your insurance.

3. Gather Your Documents: Be prepared to provide documentation to verify the qualifying life event. This might include marriage certificates, birth certificates, or termination notices.

4. Shop Around: Don't be afraid to compare quotes from different insurance providers. Your needs may have changed, and a different plan might be a better fit.

5. Seek Expert Advice: If you're feeling overwhelmed, consider consulting with an insurance broker or financial advisor. They can help you navigate your options and find the best coverage for your situation.

Common Questions About Qualifying Life Events and Insurance:

1. What is a qualifying life event?

A qualifying life event is a significant change in your life, like getting married or having a baby, that allows you to make changes to your insurance plan outside of the regular open enrollment period.

2. How long do I have to make changes after a qualifying event?

The timeframe varies, but it's typically 30-60 days from the date of the event. It's crucial to check with your insurer for specific deadlines.

3. Can I change my insurance plan at any time?

Generally, no. Outside of open enrollment, you usually need a qualifying life event to make changes to your coverage.

4. What types of insurance are affected by qualifying life events?

Qualifying life events typically impact health insurance, life insurance, and sometimes disability insurance.

5. What if my employer doesn't offer insurance during a qualifying event?

You may be able to enroll in a plan through the Health Insurance Marketplace (Healthcare.gov) during a Special Enrollment Period triggered by your qualifying event.

6. Do I need to provide proof of a qualifying event?

Yes, insurers typically require documentation to verify the qualifying event, such as a marriage certificate or birth certificate.

7. What if I miss the deadline to make changes after a qualifying event?

You may have to wait until the next open enrollment period to adjust your coverage.

8. Where can I find more information about qualifying life events and insurance?

Healthcare.gov and your insurance provider's website are great resources for detailed information about qualifying events and your options.

Tips and Tricks for Navigating Qualifying Life Event Insurance:

- Don't wait until the last minute. Start exploring your options as soon as you anticipate a qualifying event.

- Read the fine print! Understand your policy's specific terms related to qualifying life events.

- Keep thorough records of all communication and documentation related to your insurance changes.

- Don't hesitate to ask for help if you're unsure about something. Insurance can be complex, and seeking clarification is always wise.

Navigating the world of insurance doesn't have to feel like deciphering a foreign language. By understanding the ins and outs of qualifying life events, you're empowered to make informed decisions about your coverage. Remember, life is full of surprises—some delightful, some challenging—but with a little planning and awareness, you can ensure that your insurance coverage is always ready to weather the storm.

Sauk county fatal accidents understanding the tragedy

Decoding the pittsburgh steelers draft a look at player selection

Navigating newlywed life top marriage wisdom for brides