Finding the Right Fit: Applying for a Wells Fargo Credit Card Online

Remember that first apartment, the one with the slightly sticky floor and the charmingly crooked windowsill? Getting your own credit card can feel a bit like that – a step towards greater independence and financial freedom. These days, you can skip the trip to the bank and navigate the world of credit from the comfort of your couch. Yep, we're talking about applying for a credit card online.

Wells Fargo, a well-known name in the financial world, offers a variety of credit cards tailored to different needs. Maybe you're looking for cash-back rewards on everyday purchases, travel perks to fuel your wanderlust, or a low APR to help manage your finances responsibly. Applying for a Wells Fargo credit card online can be a smooth process, guiding you through each step with clear instructions.

Before diving into the application, it's wise to take a moment to consider your financial goals and spending habits. Are you aiming to build credit history, rack up rewards points, or consolidate existing debt? Understanding your priorities will help you choose a card that aligns with your aspirations.

Think of choosing a credit card like picking out a new recipe to try. You'd want to check the ingredients, read reviews, and maybe even consider the occasion. Similarly, with a credit card, you'll want to look at interest rates (APR), annual fees, rewards programs, and any introductory offers that might be on the table. It's all about finding a recipe—or in this case, a credit card—that complements your financial lifestyle.

Remember, a credit card can be a powerful tool for managing your finances, building credit, and even earning rewards. By taking the time to research and compare options, you can find a card that fits seamlessly into your wallet and your life.

Advantages and Disadvantages of Applying for a Credit Card Online

Applying for a Wells Fargo credit card online, or any credit card for that matter, comes with its own set of pros and cons. It's like weighing the pros and cons of ordering takeout versus cooking at home – both have their perks depending on your needs and preferences.

| Advantages | Disadvantages |

|---|---|

| Convenience (Apply from anywhere, anytime) | Lack of face-to-face interaction (For those who prefer in-person assistance) |

| Speed (Often a faster application process) | Potential for technical issues |

| Access to a wider range of options | Temptation to overspend or apply for more credit than necessary |

Best Practices for Applying for a Credit Card Online

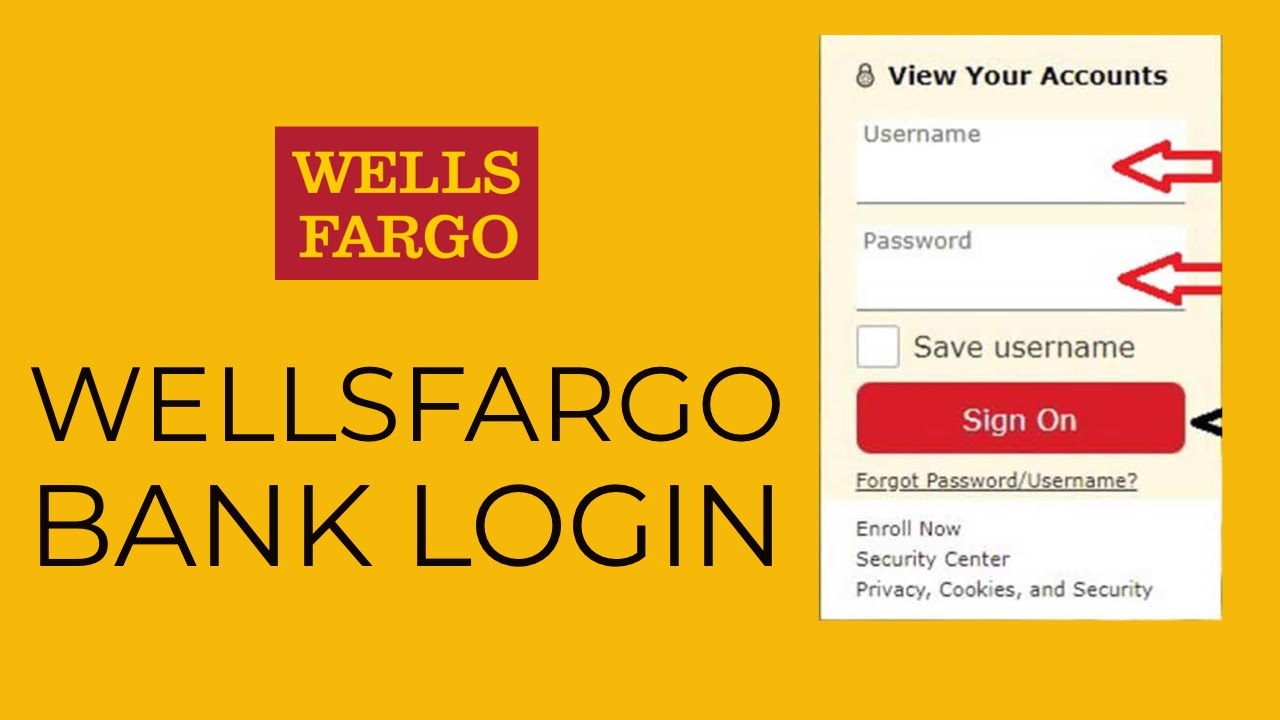

Navigating the online credit card application process can feel like learning a new dance move – it might seem tricky at first, but with a little practice, you'll be gliding through it with confidence. Here are a few tips to keep in mind:

- Check Your Credit Score: Knowing your credit score before applying can give you an idea of where you stand and what offers you might qualify for.

- Compare Card Options: Don't settle for the first shiny credit card offer you see. Take your time to compare interest rates, fees, and rewards programs to find the best fit for your financial goals.

- Read the Fine Print: Just like you wouldn't sign a lease without reading it, don't click "submit" on a credit card application without understanding the terms and conditions.

- Gather Your Information: Before you begin the online application, have all your essential information on hand, like your Social Security number, income details, and housing information.

- Keep an Eye on Your Inbox: Once you've submitted your application, keep an eye out for emails from Wells Fargo regarding the status of your application.

Common Questions About Applying for a Credit Card Online

It's natural to have questions about the online credit card application process. Here are answers to some common queries:

- Q: How long does it take to get approved for a credit card online? A: Approval times can vary, but you might receive an instant decision, or it could take a few days.

- Q: What credit score do I need to get approved for a Wells Fargo credit card? A: Credit score requirements vary depending on the specific card.

- Q: Is it safe to apply for a credit card online? A: Reputable financial institutions, like Wells Fargo, use secure websites to protect your information.

Applying for a credit card, whether online or in person, marks a significant step in your financial journey. It's an opportunity to build credit, earn rewards, and access financial tools that can help you achieve your goals. Just remember, like any good recipe or dance move, a little preparation and research can go a long way in ensuring a smooth and successful experience.

Unlocking the secrets of marine engine cooling systems

The funniest cat videos a world of laughter

Unlocking the power of the tiktok logo a transparent background guide