Endorse a Check for Mobile Deposit: Your Quick Guide

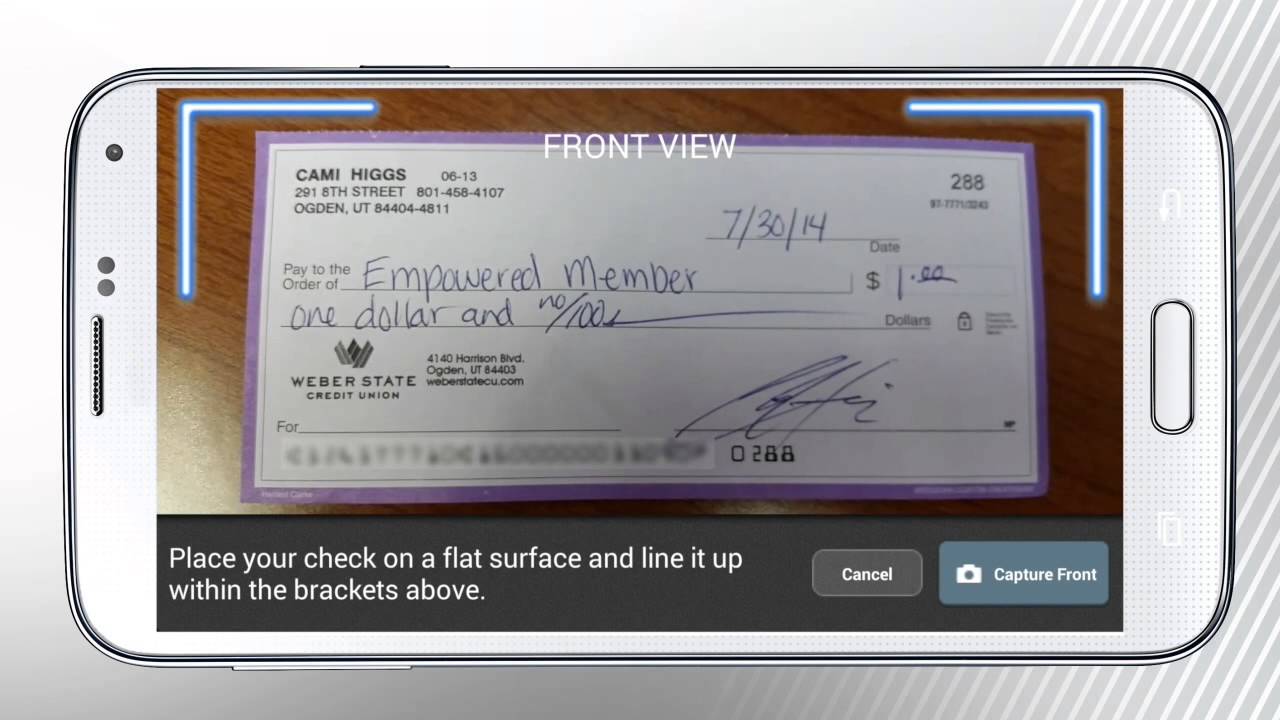

Remember the days of rushing to the bank before closing time just to deposit a check? Thankfully, those days are long gone. Now, thanks to the magic of mobile banking, you can deposit checks from anywhere, anytime – all with a few taps on your smartphone. But before you snap that photo and hit "deposit," there's a crucial step you can't afford to skip: endorsing your check correctly for mobile deposit.

You see, that little signature on the back of your check does more than just verify your identity. It's a signal to the bank that you're authorizing the transaction, making it a vital part of the mobile deposit process. But there's more to it than just scribbling your name. Doing it wrong, or even forgetting a tiny detail, can lead to delays, rejections, or even security risks.

Think of it like this: you wouldn't want to send a confidential document without a proper signature, right? The same principle applies to mobile check deposits. It's about ensuring a smooth, secure, and hassle-free experience. That's why understanding the ins and outs of endorsing checks for mobile deposit is key to unlocking the full potential of this game-changing technology.

So, whether you're new to the world of mobile banking or just want to brush up on your check-depositing skills, this guide is for you. We'll walk you through everything you need to know about endorsing checks for mobile deposit, from the basics to best practices, so you can deposit with confidence and enjoy the convenience of banking at your fingertips.

Let's face it, in our fast-paced world, convenience is king. Mobile check deposit is a perfect example of how technology is simplifying our lives, and knowing how to endorse your checks correctly is your ticket to a seamless and efficient banking experience. Let's dive in and empower you to make the most of it!

Advantages and Disadvantages of Mobile Check Deposit

While mobile check deposit offers immense convenience, it's essential to be aware of both its advantages and disadvantages:

| Advantages | Disadvantages |

|---|---|

| Deposit checks anytime, anywhere | Potential for delays in funds availability |

| Skip trips to the bank or ATM | Risk of errors if not endorsed correctly |

| Faster access to funds (in some cases) | May have deposit limits |

Best Practices for Mobile Check Deposit

Follow these best practices to ensure your mobile check deposits go smoothly:

- Check for your bank's specific instructions. Different banks may have slightly different requirements for endorsing checks for mobile deposit.

- Use a dark ink pen. This helps ensure that your signature and endorsement are legible in the photo.

- Write clearly and legibly. Illegible endorsements can lead to processing delays.

- Take clear photos. Good lighting and a steady hand will help ensure your check image is clear and readable.

- Keep your check for a reasonable period. Your bank may advise you to hold onto the physical check for a certain duration after the deposit just in case any issues arise.

Common Questions and Answers

Here are some frequently asked questions about endorsing checks for mobile deposit:

- What does "for mobile deposit only" mean? Adding this phrase next to your signature adds an extra layer of security. It means the check can only be deposited via a mobile app and not in person at a bank.

- What if I make a mistake while endorsing the check? It's best to request a new check if possible. If you must use the same check, contact your bank for guidance on correcting the endorsement.

- Can I deposit a check that's made out to someone else? Generally, no. Mobile check deposit is typically for checks where you are the named payee.

- How long does it take for a mobile check deposit to clear? Clearing times vary by bank. Check with your bank for their specific policies.

- What happens if my mobile check deposit is rejected? Your bank will typically notify you of the reason and provide instructions on how to fix the issue.

- Is it safe to endorse a check for mobile deposit? Yes, as long as you are using a reputable banking app and following security best practices.

- Can I deposit a check that's been folded or slightly damaged? Minor wear and tear are usually acceptable, but avoid depositing checks with significant damage.

- Do I need a special app to endorse checks for mobile deposit? You will need to use your bank's mobile banking app. Most banks have this functionality built in.

Conclusion: Embrace the Future of Banking

Endorsing a check for mobile deposit might seem like a small detail, but it's a crucial step in unlocking a world of banking convenience at your fingertips. By understanding the simple process and following the best practices we've outlined, you can confidently say goodbye to those time-consuming bank trips and enjoy the ease of depositing checks anytime, anywhere. So, the next time you have a check to deposit, remember these tips and experience the future of banking – one mobile deposit at a time!

Ea sports fc 24 ps4 your ultimate guide

A delicious journey exploring the enchanting world of one piece whole cake characters

Unlocking third grade math mastering common core assessments