Ditch the Bank Lines: Conquer with Wells Fargo Mobile Check Deposit

Remember the days when depositing a check meant carving time out of your day, battling traffic, and standing in line at the bank? Those days are as outdated as a payphone! Thanks to the marvels of modern technology, we now have tools like Wells Fargo Mobile Check Deposit, transforming the once-dreaded chore of check depositing into a quick and painless task you can do from your couch (or even a mountaintop, if that's your thing!).

But is this digital magic show all it's cracked up to be? How does it work, and are there any hidden gotchas? We're going to break down everything you need to know about Wells Fargo Mobile Check Deposit, from its humble origins to its potential pitfalls, so you can decide if it's the right financial sidekick for you.

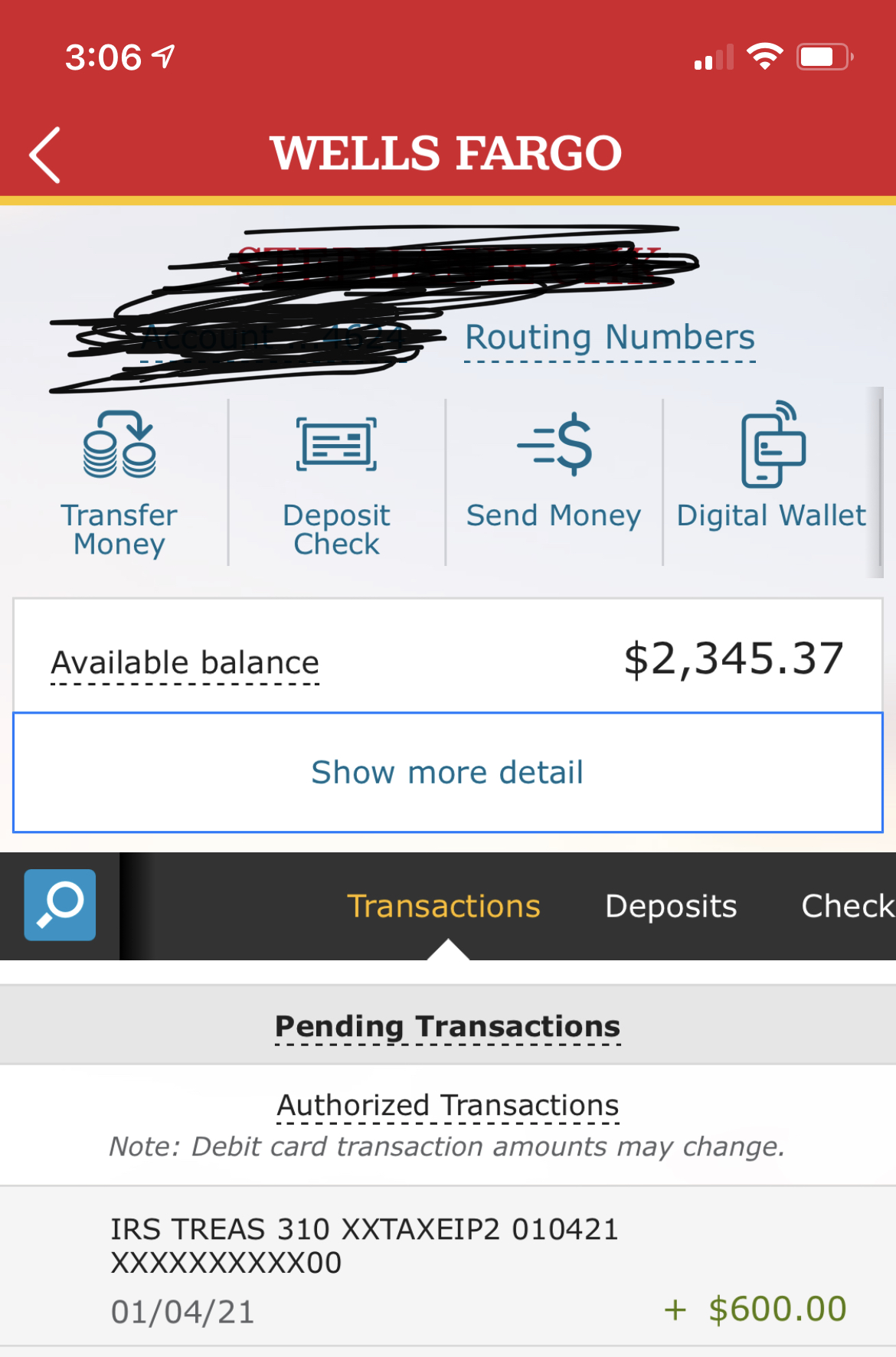

Imagine this: you're fresh off a freelance victory, invoice paid and celebratory coffee in hand. Suddenly, you remember that ancient scroll – a physical check – sitting on your desk. Pre-digital-age you would have begrudgingly added "deposit check" to your to-do list, but today, you simply snap a picture, hit a few buttons on your phone, and bam! Funds on their way to your account, just like that. That's the power of Wells Fargo Mobile Check Deposit.

No more sacrificing precious free time to the banking gods. With Wells Fargo Mobile Check Deposit, you’re in the driver's seat. Deposit checks anytime, anywhere, and watch your financial freedom grow. Sounds good, right?

While banks have offered online banking for a while, mobile check deposit is a relatively new feature. It's part of a larger trend towards making banking more convenient and accessible. Wells Fargo, being one of the largest financial institutions in the US, was quick to adopt this technology, recognizing the value it brings to its customers.

Advantages and Disadvantages of Wells Fargo Mobile Deposit

| Advantages | Disadvantages |

|---|---|

|

|

Mobile check deposit is a game changer for many, but it's not without its quirks. Here’s the deal:

Best Practices for Smooth Sailing with Mobile Check Deposit

Follow these tips to become a mobile deposit ninja:

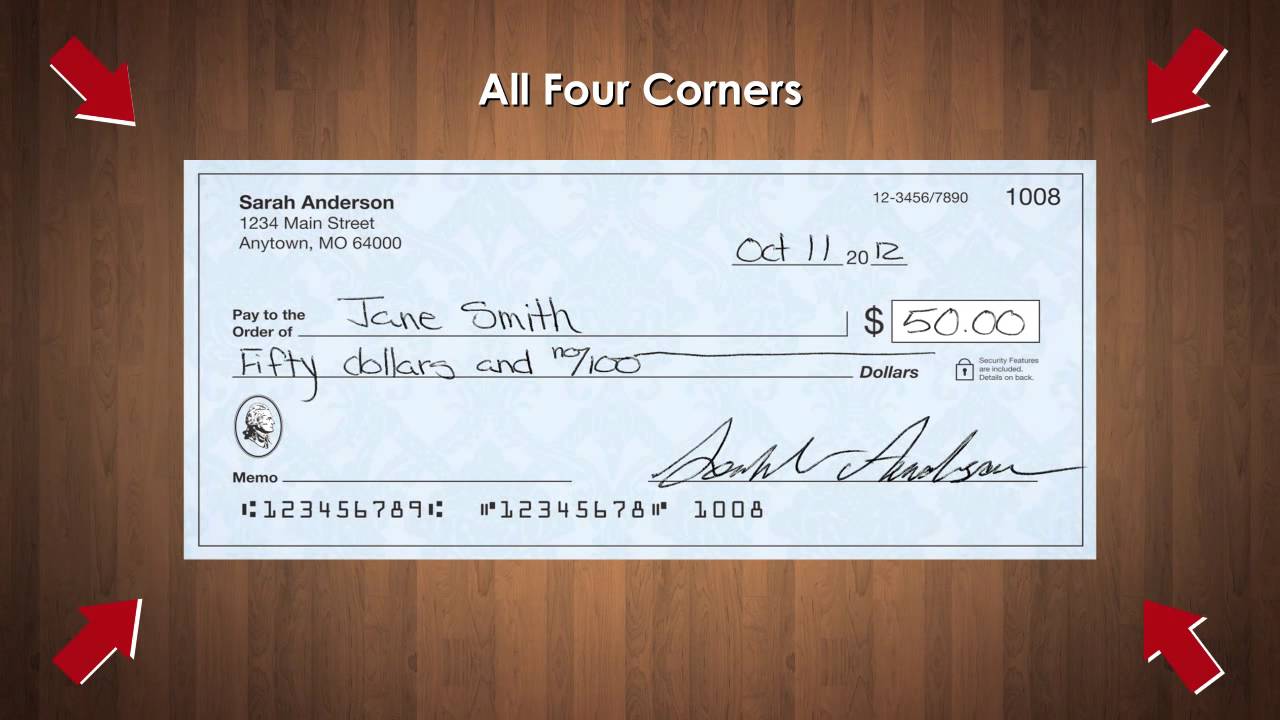

- Light is Right: Good lighting is key for clear photos. Natural light is best, but avoid glare.

- Steady Hand, Perfect Shot: Hold your phone steady and ensure the check is fully captured within the designated area.

- Endorsement is Essential: Don't forget to endorse your check and add "For Mobile Deposit Only."

- Keep it Crisp: Make sure your check is in good condition – no tears, wrinkles, or fading ink.

- Double-Check, Then Deposit: Always review your deposit details before hitting submit to avoid any errors.

While mobile check deposit is designed to be simple, a few common questions pop up:

FAQs: Your Burning Questions, Answered!

Q: Is there a fee for using Wells Fargo Mobile Check Deposit?

A: Generally, no. Wells Fargo typically doesn't charge fees for mobile check deposits. However, it’s always wise to double-check your account terms and conditions.

Q: How long does it take for a mobile deposit to clear?

A: Most mobile check deposits process within 1-2 business days. However, some deposits may take longer depending on various factors.

Q: Can I deposit any type of check using mobile deposit?

A: While most personal checks are accepted, certain types of checks might not be eligible for mobile deposit. Check with Wells Fargo for specific details.

Q: What happens if I make a mistake when depositing a check?

A: If you realize you've made a mistake, contact Wells Fargo customer service immediately. They can help you correct the error.

Q: What do I do with the physical check after I've deposited it through the app?

A: It's recommended to keep the physical check for a short period (a week or two) after the deposit has cleared your account. Mark it as “Deposited” and store it securely until then, just in case any issues arise.

Q: Are there any limits on how much I can deposit through mobile check deposit?

A: Yes, there might be daily or monthly deposit limits for mobile check deposits. You can find these limits in your account details or on the Wells Fargo website.

Q: Is mobile check deposit secure?

A: Wells Fargo uses various security measures to protect your transactions, including encryption and fraud monitoring.

Q: What if I don't have a smartphone? Can I still use mobile check deposit?

A: Unfortunately, mobile check deposit requires a smartphone or tablet with a camera and internet access. However, you can explore other convenient options like ATM deposits or online bill pay through your computer.

Level Up Your Finances

Wells Fargo Mobile Check Deposit is more than just a cool feature; it's a powerful tool for taking control of your finances. It empowers you to manage your money efficiently, avoid unnecessary fees, and focus on what truly matters. Ready to ditch the bank lines and step into the future of banking? Download the Wells Fargo app today and experience the freedom of banking on your terms!

Pop princesses emo anthems reliving the reign of 2000s pop

Powering up with cheng yong electrical systems your guide to reliable electrical solutions

Bump on dog paw pad what every owner needs to know