Decoding AARP Supplemental Insurance Costs

Are you considering supplementing your Medicare coverage with an AARP plan? Understanding the costs associated with AARP supplemental insurance is crucial for making informed decisions about your healthcare. This comprehensive guide will delve into the various aspects of AARP supplemental insurance pricing, helping you navigate the complexities and find the right plan for your needs and budget.

Navigating the healthcare landscape can be daunting, especially as we age. Medicare provides a foundation, but it doesn't cover everything. This is where supplemental insurance, often offered through organizations like AARP, comes into play. But just how much does this added protection cost?

AARP, a prominent advocacy group for individuals over 50, partners with UnitedHealthcare to offer a range of Medigap plans, often referred to as AARP supplemental insurance. These plans help cover costs that Original Medicare doesn't, such as copayments, coinsurance, and deductibles. The price of these plans varies depending on a number of factors.

Understanding what influences the cost of AARP supplemental insurance is key to selecting the right plan. Factors like your location, age, chosen plan, and any pre-existing conditions can all impact your premium. It's essential to compare different plans and understand their coverage options to determine which one best suits your individual circumstances and financial situation.

This article will explore the nuances of AARP Medigap pricing, providing you with the knowledge you need to make informed decisions about your healthcare coverage. We'll cover the factors affecting plan costs, the different plan options available, and how to find the most cost-effective solution for your specific needs.

The UnitedHealthcare/AARP Medigap plans have a rich history tied to the evolution of Medicare itself. As Medicare became more complex, the need for supplemental coverage grew, leading to the development of standardized Medigap plans. AARP partnered with UnitedHealthcare to offer these plans to its members, providing a trusted source for supplemental insurance.

AARP supplemental insurance aims to bridge the gaps in Original Medicare coverage. This is crucial for protecting individuals from potentially high out-of-pocket expenses. One of the main issues surrounding supplemental insurance is understanding the different plan options and their associated costs. This can be confusing for many, hence the need for clear and accessible information.

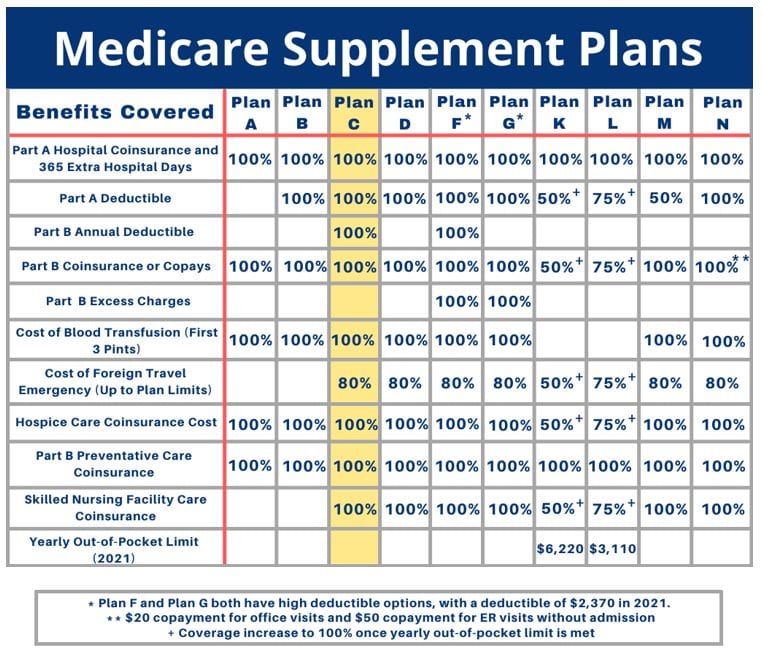

AARP supplemental insurance plans are labeled with letters, such as Plan A, Plan G, and Plan N. Each plan offers different levels of coverage, and therefore, different pricing structures. For example, Plan F offers the most comprehensive coverage (for those eligible) and typically has a higher premium, while Plan K offers less coverage but has a lower premium.

Benefits of AARP Supplemental Insurance:

1. Predictable Healthcare Costs: Knowing your supplemental insurance premium helps you budget for healthcare expenses, eliminating the uncertainty of unexpected medical bills.

2. Enhanced Coverage: AARP plans cover many out-of-pocket expenses that Original Medicare doesn't, providing more comprehensive protection.

3. Peace of Mind: Having supplemental insurance offers peace of mind, knowing you are financially protected in the event of illness or injury.

Action Plan for Choosing AARP Supplemental Insurance: 1. Assess your needs: Consider your health status, budget, and desired level of coverage. 2. Compare plan options: Research the different AARP Medigap plans and their benefits. 3. Get a personalized quote: Contact UnitedHealthcare to get a quote based on your specific information. 4. Enroll in a plan: Once you've chosen a plan, complete the enrollment process.

Advantages and Disadvantages of AARP Supplemental Insurance

| Advantages | Disadvantages |

|---|---|

| Predictable Costs | Monthly Premiums |

| Comprehensive Coverage | Can be Expensive Depending on the Plan |

| Peace of Mind | May Not Cover All Medical Expenses |

FAQs:

1. What is AARP Supplemental Insurance? - It's Medigap coverage offered through UnitedHealthcare to AARP members.

2. How much does it cost? - Costs vary based on plan, location, and age.

3. What factors affect the cost? - Age, location, chosen plan, and health status.

4. How do I get a quote? - Contact UnitedHealthcare directly or visit their website.

5. What plans are available? - Standardized Medigap plans, labeled with letters (A, G, N, etc.).

6. What does it cover? - Costs that Original Medicare doesn't, like copayments and coinsurance.

7. When can I enroll? - Typically during your Medigap Open Enrollment Period.

8. How do I choose the right plan? - Consider your individual needs and budget.

Tips and Tricks:

Compare quotes from different insurance providers to ensure you're getting the best price. Carefully review the plan details and coverage options before making a decision. Consult with a licensed insurance agent to discuss your specific needs and get personalized advice.

In conclusion, understanding the costs associated with AARP supplemental insurance is essential for making informed decisions about your healthcare. By carefully considering your individual needs, researching different plan options, and comparing quotes, you can find the right coverage to supplement your Medicare benefits and protect your financial well-being. AARP supplemental insurance provides valuable peace of mind, knowing you have a safety net in place to help manage unexpected medical expenses. Take the time to explore the available options and secure the coverage that best suits your circumstances. Don't hesitate to reach out to UnitedHealthcare for personalized assistance and guidance. Taking proactive steps today can pave the way for a healthier and more secure tomorrow.

Unlocking the potential of xing hong tai electronics a comprehensive guide

Comenity pay bh web

Navigating power outages in tennessee