Calculating Zakat on Income in Negeri Sembilan: A Comprehensive Guide

In the heart of Malaysia, where faith intertwines with daily life, understanding one's financial obligations within the Islamic framework is paramount. For Muslims in Negeri Sembilan, fulfilling the pillar of Zakat, a form of obligatory almsgiving, is a crucial aspect of their religious duty. While Zakat encompasses various categories, Zakat on income, known as Zakat Pendapatan, holds particular significance in today's world.

Imagine a society where wealth is shared, poverty is alleviated, and the blessings of Allah (SWT) flow through acts of generosity. This is the vision that Zakat aims to achieve. But how does one navigate the specifics of calculating Zakat on income, especially in the context of Negeri Sembilan's regulations and guidelines?

This comprehensive guide delves into the intricacies of calculating Zakat Pendapatan in Negeri Sembilan, providing clarity and guidance for those seeking to fulfill this vital Islamic obligation. We'll unravel the complexities, address common questions, and empower you with the knowledge to approach Zakat with confidence.

Whether you're new to the concept of Zakat or seeking a refresher on the specific calculation methods used in Negeri Sembilan, this guide will equip you with the tools to understand your Zakat obligations and contribute to the well-being of your community.

Join us as we embark on a journey to unravel the details of Zakat calculation, ensuring your financial worship is both accurate and meaningful.

Advantages and Disadvantages of Understanding Zakat Calculation

| Advantages | Disadvantages |

|---|---|

| Fulfilling your religious obligation | Requires careful record-keeping |

| Contributing to poverty alleviation and community development | May involve seeking guidance from religious authorities for complex financial situations |

| Purifying your wealth and seeking blessings from Allah (SWT) |

Best Practices for Calculating and Paying Zakat Pendapatan

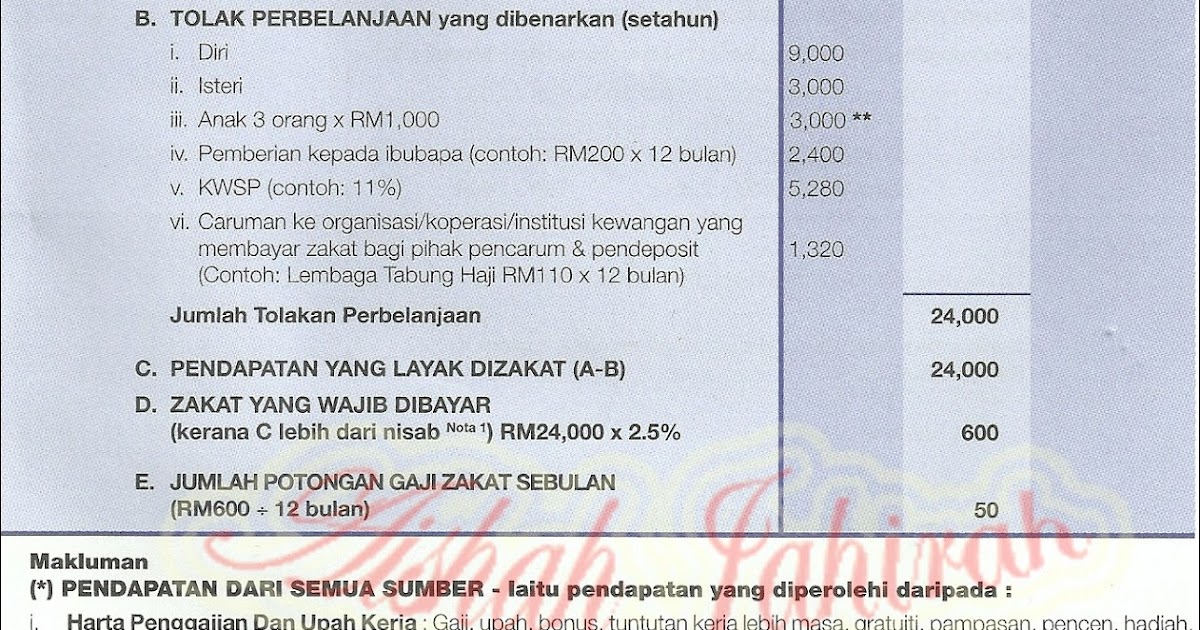

Accurately calculating and paying your Zakat is crucial. Here are five best practices:

- Maintain Detailed Records: Keep meticulous records of your income and expenses. This simplifies the calculation process and ensures accuracy.

- Consult Official Sources: Refer to the official guidelines and resources provided by the Negeri Sembilan Islamic Religious Council (MAINS) for the most up-to-date information.

- Seek Clarification When Needed: Don't hesitate to reach out to MAINS or qualified religious scholars if you have any doubts or require clarification on specific aspects of Zakat calculation.

- Utilize Zakat Calculators: Take advantage of online Zakat calculators offered by reputable Islamic organizations. These tools can simplify the process, especially for those with multiple income sources.

- Pay Zakat Promptly: Once calculated, strive to pay your Zakat promptly to fulfill your obligation in a timely manner.

Understanding how to calculate Zakat on your income in Negeri Sembilan is not merely a financial exercise; it's a spiritual practice that brings you closer to Allah (SWT) and strengthens the bonds of community. By fulfilling this important pillar of Islam, you're contributing to a more just and equitable society, where the less fortunate are cared for, and the blessings of Allah (SWT) are shared by all.

Unveiling the mystery what does the word root loch mean in english

Chasing the dream a guide to knight rider kit cars

The art of alias unpacking the allure of offensive codenames